#HTE

Hello and welcome back to TechCrunch’s China Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. This week, a post from Sequoia Capital sounding the alarm of the coronavirus’s impact on businesses is reaching far corners of tech communities around the world, including China.

Many echo Sequoia’s observation that the companies that are the “most adaptable” are the likeliest to survive. Others cling to the hope of “[turning] a challenging situation into an opportunity to set yourself up for enduring success.”

Two weeks ago I wrote about how the private sector and the government in China are working together to contain the epidemic, bringing a temporary boost to the technology industry. This week I asked a number of investors and founders which of these changes will stand to last, and why.

B2B on the rise

The business-to-business (B2B) space was rarely a hot topic in China until online consumer businesses became relatively saturated in recent times. And now, the COVID-19 epidemic has unexpectedly breathed life into the once-boring field, which stretches from virtual meetings, online education, digital healthcare, cybersecurity, telecommunications, logistics to smart cities, analysis from investment firm Yunqi Partners shows.

For one, there is an obvious opportunity for remote collaboration tools as people work from home. Downloads of indigenous work apps like Dingtalk, WeChat Work, TikTok’s sister Lark as well as America’s Zoom jumped exponentially amid the health crisis. While some argue that the boom is overblown and will dissipate as soon as businesses are back to normal, others suggest that the shift in behavior will endure.

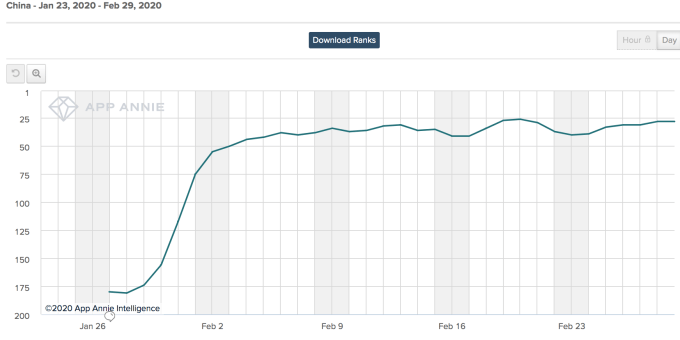

Like other work collaboration services, Zoom soared in China amid the coronavirus outbreak, jumping from No. 180 in late January to No. 28 as of late February in overall app installs. Data: App Annie

“People are reluctant to change once they form a new habit,” suggests Joe Chan, partner at Hong Kong-based Mindworks Ventures. The virus outbreak, he believes, has educated the Chinese masses to work remotely.

“Meeting in person and through Zoom both have their own merits, depending on the social norm. Some people are used to thinking that relationships need to be established through face-to-face encounters, but those who don’t hold that view will have fewer meetings. [The epidemic] presents a chance for a paradigm shift.”

But changes are slow

Growth in enterprise businesses might be less visible than what China witnessed over the SARS epidemic that fueled internet consumer verticals such as ecommerce. That’s because software-as-a-services (SaaS), cloud computing, health tech, logistics and other enterprise-facing services are intangible for most consumers.

“Compared to changes in consumer behavior, the adoption of new technologies by enterprises happen at a slower pace, so the impact of coronavirus on new-generation innovations [B2B] won’t come as rapidly and thoroughly as what happened during SARS,” contended Jake Xie, vice president of investment at China Growth Capital.

Xie further suggested that the opportunities presented by the outbreak are reserved for companies that have been steadily investing in the field, in part because enterprise services have a longer life cycle and require more capital-intensive infrastructure. “Opportunists don’t stand a chance,” he concluded.

As for changing consumer behavior, such as the uptick in grocery delivery usage by seniors trapped indoors, the impact might be short-lived. “The only benefit that the epidemic brings to these apps is getting more people to try their services. But how many of them will stay? The argument that people will keep using these apps over concerns of getting sick in offline markets is unsubstantiated. The strength of a business lies in its ability to solve user problems in the long term, for example, providing affordability and convenience,” suggested Derek Shen, chairman of Danke Apartment, the Chinese co-living startup slated to list on NYSE.

Summoned by Beijing

The adjacent sector of enterprise services — at-scale technologies tailored to energizing government functions — has also seen traction over the course of the epidemic. Private firms in China have teamed up with regional authorities to better track people’s movements, ramp up facial recognition capacities aimed at a mask-wearing public, develop contact-free consumer experience, among other measures.

Tech firms touting services to the government are no stranger to criticisms concerning the lack of transparency in how user data is used. But the appeal to private firms is huge, not only because state contracts tend to provide a steady stream of long-term revenue, but also that certain public-facing projects can be billed as a fulfillment of corporate social responsibilities. Following the virus outbreak, Chinese tech companies of all sizes hastened to offer contributions, with efforts ranging from making monetary donations to building tools that keep the public informed.

On the flip side, the government also needs private help in emergency management. As prominent Chinese historian Luo Xin poignantly pointed out in podcast SurplusValue’s recent episode [1:00:00], some of the most efficient and effective responses to the public health crisis came not from the government but the private sector, whether it is online retailer JD.com or logistics firm SF Express delivering relief supplies to the epicenter of the outbreak.

That said, Luo argued there are signs that some local authorities’ tendency to centralize control is getting in the way of private efforts. For example, some government offices have stumbled in their attempts to develop crisis management systems from scratch, overlooking a pool of readily available and proven infrastructure powered by the country’s tech giants.

https://techcrunch.com/2020/03/08/china-roundup-enterprise-tech-gets-a-lasting-boost-from-coronavirus-outbreak/