techcrunch

#HTE

Xiaomi, Vivo, Samsung, Oppo and other smartphone companies have received approval from some state governments in India to partially resume manufacturing and assembling of devices amid the ongoing lockdown in the world’s second largest handset market that completely shut operations at these plants in late March.

The companies said that they have secured permission to kick start their manufacturing operations in the country, though several restrictions such as operating with limited workforce are still in place. (The federal government allowed the resumption of smartphone production earlier this month, but state governments have the final say on whether the local conditions are safe enough to enforce the relaxation.)

New Delhi’s decision comes days after it extended the lockdown by two weeks earlier this month but eased some restrictions to revive economic activity that’s been stalled since the stringent stay-at-home orders were imposed across the nation in late March.

Earlier this week, the government permitted e-commerce firms and ride-hailing services to resume services in green and orange zones, districts that have seen less severe outbreak of the coronavirus, across the country. Green and orange zones account for 82% of India’s 733 districts.

Xiaomi, which launched a range of gadgets in India today including its Snapdragon 865-powered Mi 10 smartphone, said earlier this month that it only had inventory to meet demand for up to three weeks.

Manu Kumar Jain, a VP at Xiaomi who oversees the Chinese firm’s business in India, said today that the company, which has been the top smartphone vendor in the country for more than two years, would restart operations in its contract partner Foxconn’s facility in the state of Andhra Pradesh.

A person familiar with the matter told TechCrunch that Wistron, a contract partner of Apple, has started limited operations for the iPhone-maker in Bangalore.

Vivo, the second largest smartphone vendor in India, said the company will resume production at 30% of their capacity. “We shall begin production with around 3,000 employees,” a Vivo spokesperson said.

Like Vivo, Oppo will also resume production at its Greater Noida facility with around 3,000 employees who would work in rotation, it said. Samsung, which opened the world’s biggest smartphone factory in India in 2018, said it will restart production in that factory.

“On Thursday, the factory started limited operations, which will be scaled up over a period of time. Employee safety and well-being remaining our absolute priority, we have ensured that all hygiene and social distancing measures are maintained at the premises, as per government guidelines,” said a Samsung spokesperson.

The coronavirus outbreak has severely disrupted several businesses. India did not see any handset sale last month, according to research firm Counterpoint. Counterpoint estimated that the smartphone shipments in India will decline by 10% this year, compared to a 8.9% growth in 2019 and 10% growth in 2018.

Every top smartphone maker in India has either established its own manufacturing plant or partnered with contract vendors to produce units locally in recent years to avail the tax benefits that New Delhi offers.

https://techcrunch.com/2020/05/08/xiaomi-samsung-and-others-begin-to-resume-smartphone-production-in-india/

#HTE

Private equity firm Vista Equity Partners said on Friday it would invest $1.5 billion in Reliance Jio Platforms joining social conglomerate Facebook and private equity firm Silver Lake that have also made similar bets on the Indian telecom giant in recent weeks.

The planned announcement, which would give U.S.-headquartered software-focused buyout firm Vista Equity Partners a 2.32% stake in Reliance Jio Platforms, values India’s top telecom operator at $65 billion (equity valuation) — the same valuation implied by the Silver Lake investment, the Indian firm said.

Reliance Jio Platforms, which began its commercial operation in the second half of 2016, upended the local telecom market by offering bulk of 4G data and voice calls for six months to users at no charge. A subsidiary of Reliance Industries (India’s most valuable firm by market value), Jio Platforms has amassed 388 million subscribers since its launch to become the nation’s top telecom operator.

The Indian firm said on Friday that it aims to make Reliance Jio Platforms, in which it has poured more than $30 billion over the years, “a global technology leader and among the leading digital economies in the world.”

Vista, which began investing in software firms 20 years ago, said it would explore ways to expand the reach of its portfolio companies’ products and services in India.

“We are thrilled to join Jio Platforms to deliver exponential growth in connectivity across India, providing modern consumer, small business and enterprise software to fuel the future of one of the world’s fastest growing digital economies,” said Robert F. Smith, Founder, Chairman and CEO of Vista in a statement.

The new commitment would help India’s richest man, Mukhesh Ambani, who runs Reliance Industries, further cement his last year’s commitment to investors when he said he aimed to cut Reliance’s net debt of about $21 billion to zero by early 2021. Its core business, oil refining and petrochemicals, has been hard hit amid the coronavirus outbreak. Its net profit in the quarter that ended on March 31 fell by 37%.

In the company’s earnings call last month, Ambani said several firms had expressed interest in buying stakes in Jio Platforms in the wake of the deal with Facebook.

Facebook said that other than offering capital to Jio Platforms for a 9.99% stake in the firm, it would work with the Indian giant on a number of areas starting with e-commerce. Days later, JioMart, an e-commerce venture run by India’s most valued firm, began testing an “ordering system” on WhatsApp, the most popular smartphone app in India with over 400 million active users in the world’s second largest internet market.

More to follow…

https://techcrunch.com/2020/05/07/vista-equity-partners-to-invest-1-5b-in-indian-telecom-giant-reliance-jio-platforms/

#HTE

As investors get cautious about dealmaking in India amid the coronavirus outbreak and their appetite to fund early stage startups begins to evaporate, one venture capital fund is stepping up to make that void smaller.

WaterBridge Ventures, an investor that has cut some of the earliest checks in startups such as edtech firms Unacademy and Doubtnut, and Atlan, which helps enterprises better manage data, has launched Fast Forward, a program with a committed $10 million from its second fund to finance Seed and pre-Series A rounds in more than a dozen startups.

Any early-stage startup can apply in Fast Forward by answering 10 questions, and WaterBridge partners will engage with them virtually and conclude whether they want to invest within 10 days, said Manish Kheterpal, founder and managing partner at the VC fund.

“Most young entrepreneurs in India have no experience. They have either just graduated or dropped out of college. If we put a normal VC lens to evaluate them, they fall flat as they don’t have any experience, so you end up not investing. We want to back some of those ideas,” said Kheterpal in an interview with TechCrunch.

The launch’s timing is also interesting. Kheterpal, a veteran investor, said WaterBridge began exploring the program last year and the coronavirus crises convinced him to launch it now as it could serve a greater purpose.

Several early-stage startups have told TechCrunch in recent weeks that they are finding it incredibly challenging to get in touch with some VCs in the country amid the coronavirus crises.

Founder of a social commerce startup who requested anonymity said that most VCs he has attempted to reach out are currently only engaging with founders they knew from prior to the outbreak.

“We think it’s exactly the right time to invest. History has shown us that some of the best firms have emerged from the crises,” said Kheterpal.

The startups that are selected in Fast Forward will have the capital in their bank account in 20 days. The check comes in two sizes: $135,000, aimed at startups that have not built the product yet, and $330,000 for those who have some semblance of the product but may not have started to generate revenue yet. WaterBridge Ventures will take 15% equity in the startup in return.

Fast Forward is open to investing in nearly every category, though it is avoiding at least two: Hardware manufacturing and real estate, two areas that have proven challenging for scale in the country.

Fast funding is not a new idea, though it’s yet to receive wider traction among VC funds. NFX, an investor in early-stage startups, launched a seed-funding initiative last month to invite founders in the U.S. to apply for seed funding of $1 million to $2 million in exchange for 15% of their company.

https://techcrunch.com/2020/05/07/this-venture-firm-in-india-is-offering-fast-funding-to-early-stage-startups-in-a-time-of-uncertainty/

#HTE

Some of you may recall the South Korean app Zepeto that went viral among Gen Z users a year and a half ago. The app, which renders selfies into animated avatars and lets people adorn their computer-generated manifestations with virtual items, appears to have sustained its relevance. It has amassed 150 million registered users, the company told TechCrunch recently, although its number of monthly active users, which is a better metric to gauge an app’s performance, hovers around 10 million.

China is by far the largest market for Zepeto, locally known as Zaizai (崽崽), an affectionate nickname for children. “Zaizai aspires to develop into a comprehensive ecosystem while also offering robust content across China,” affirmed CEO Daewook Kim.

The app could benefit from its pedigreed background. It’s developed by the selfie app Snow, of which parent company Naver also owns the Asian messaging giant Line.

It’s not uncommon for a popular photo-editing tool to fade out as people move onto the next trending alternative, either because the new player arrives with more impressive visual capabilities or its marketing stunt creates a spell on many — or both. As such, apps that are disposable and serve utility purposes often have to think hard about retaining their users or engage aggressively to monetize them while the going is still good.

Zepeto did both.

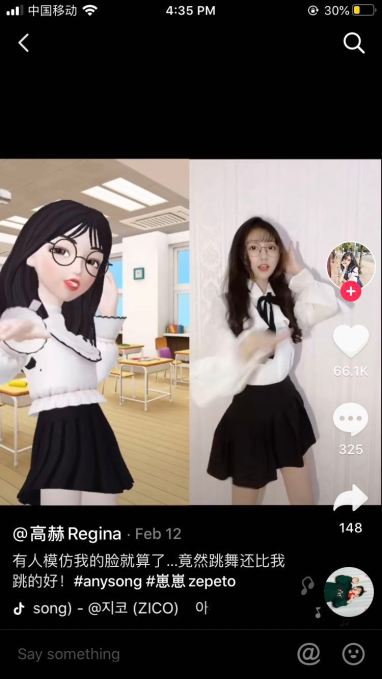

Screenshot: a user shares videos of herself dancing and her Zepeto character dancing on Douyin

The app includes a social networking function where users can interact anonymously through their avatars in virtual spaces akin to The Sims. The challenge with that, of course, is building a big enough network that lures people to keep returning.

Zepeto also comprises of a series of mini games that are evocative of what Lee described as peaceful exploration people are enjoying in red-hot Animal Crossing.

In other words, the business is ripe for selling virtual items. Indeed, the leader in this category of business, Tencent, once generated the bulk of its income from the items it sold to decorate users’ virtual profiles and spaces, a business modeled on the South Korean internet pioneer Cyworld. That was before Tencent earned a wider global reputation by building WeChat and operating blockbuster video games.

Zepeto has so far generated some $10 million from 600 million pieces of virtual items sold. It stepped up the effort recently by launching a creative marketplace where third-party artists can offer their virtual lines of clothes and accessories. Called Zepeto Studio, the store clocked around $700,000 in sales in its first month. Many add-ons are branded — a common strategy for photo-enhancement apps — so you can sport things like virtual Nike apparel.

“We’ve partnered with global brands like Disney and Nike, as well as celebrities like BTS. We hope to continue to bring exciting partnerships to Zaizai Studio as well as better service to our creators,” said Rudy Lee, head of Zepeto’s global business, adding that the Studio feature for China is scheduled to launch mid-May.

Branded Nike apparel on Zepeto

If enough people keep using Zepeto, the third-party store can be a lucrative pursuit for designers. Among Zepeto’s 60,000 registered artists, the highest-paid creator pocketed some $9,000 in sales in the first month.

But as numbers grow, Zepeto is also getting cautious about keeping its marketplace civil. The firm maintains an internal moderation team that weeds out “political messaging, hate speech, or discriminatory messaging on the virtual clothes,” said Lee. The rule is particularly pertinent to its development in China where the flow of information is strictly controlled.

Another way to survive as a utility tool is to piggyback off another app’s success. We have written about the way PicsArt, a photo-editing app that rivals VSCO, managed to stay in the game by supporting TikTok-inspired stickers. Zepeto has taken notice. Many of its users are now sharing their animated avatars on Douyin, the Chinese edition of TikTok, observed Lee.

https://techcrunch.com/2020/05/06/snows-avatar-app-zepeto-150-million-users-china-push/

#HTE

Xiaomi today launched a new e-commerce service in India that allows people in the nation to easily browse and order its handsets and other products from nearby physical retail stores as the Chinese giant rushes to kickstart its sales in its biggest overseas market.

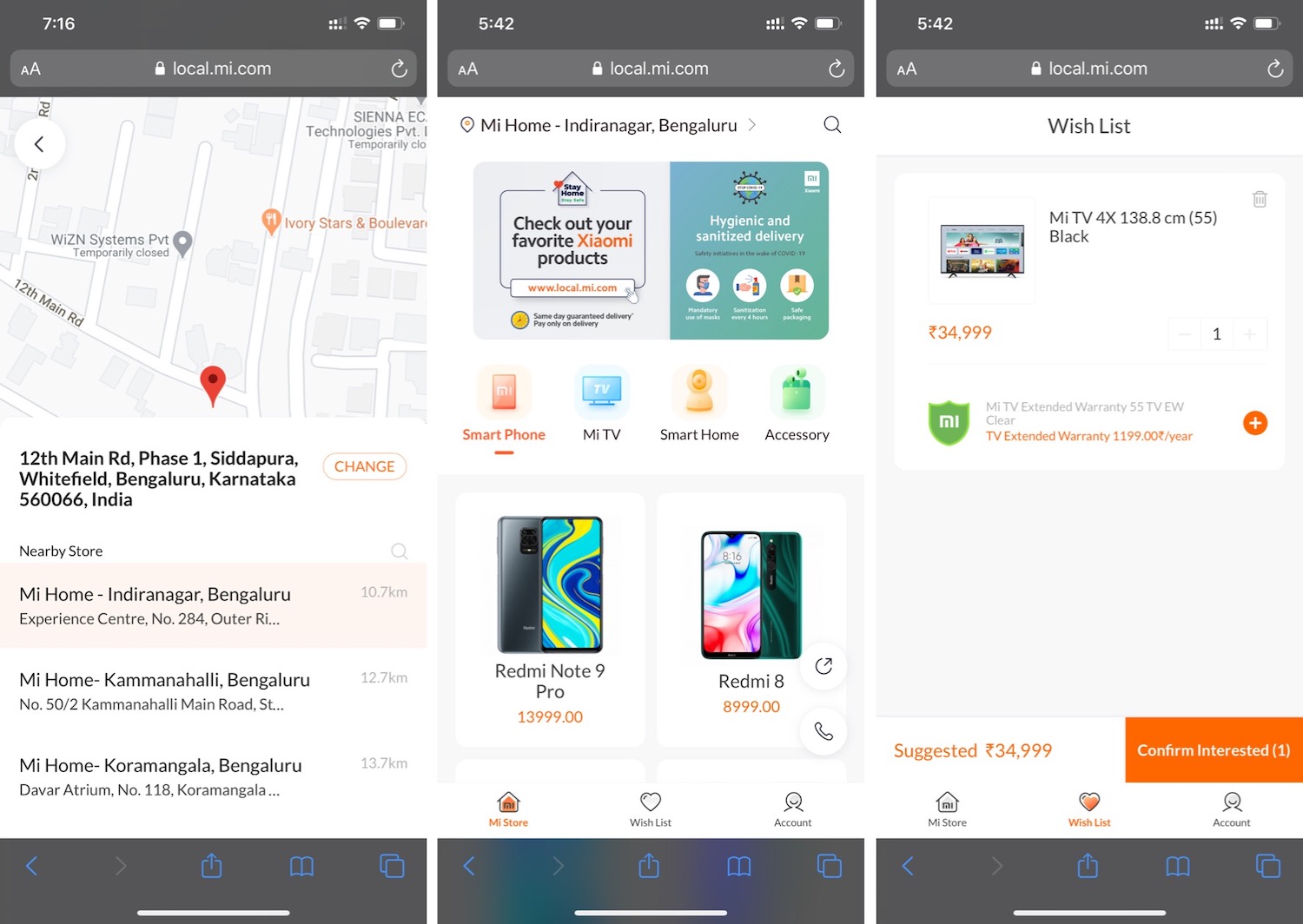

Dubbed Mi Commerce, the service allows people to locate nearby stores that are either run by Xiaomi or those that have tie-ups with the company and browse smartphones, TVs, electric lamps, and a range of other products.

Users can express their “interest” to purchase the selected item through the app that would prompt the retail store to place a confirmation call. The retail store would deliver the item and then process the payment, Xiaomi said. A spokesperson told TechCrunch that Mi Commerce is available only in India currently.

Xiaomi has also launched a WhatsApp Business account that operates on a similar flow. Users can send a message to +91 8861826286 to initiate the conversation with retail stores through Facebook-owned service.

The shift to what is often described in the industry as an online to offline model comes as Xiaomi, like other smartphone vendors, looks to make up its lost sales in recent weeks. India ordered a nationwide lockdown in late March that shut retail shops, and restricted e-commerce firms to only service grocery orders.

According to Hong Kong-headquartered research firm Counterpoint, no smartphone units were sold in India, the world’s second largest smartphone market, in April.

In a call with reporters, Xiaomi executives said they were hopeful that the Indian market would attain at least 80% of its momentum by the end of the year. Counterpoint slashed its smartphone projections for India last month, saying it now expects the market to shrink by 10% this year. Indian smartphone market has consistently grown year-by-year in the last decade.

Mi Commerce would additionally also help potential customers maintain social distance and avoid errands to stores that would otherwise expose them to novel coronavirus.

Xiaomi said it was working with the government for an update on the resumption of smartphone manufacturing plants that are also shut since the lockdown was ordered in March. The company executives said they currently have inventory to meet demand for three to four months.

The Chinese giant is also providing working capital to its retail store partners, it said.

Samsung, which lost the tentpole position in India’s smartphone market to Xiaomi in 2018 and recently the second spot to Vivo, did not respond to TechCrunch’s request for comment on any similar efforts it has made — or not made — in India.

On Monday, e-commerce firms including Amazon and Walmart in India resumed their service for people in more than 80% zip codes in the country. A lockdown would remain in place for another two weeks in India, but New Delhi has eased some restrictions.

https://techcrunch.com/2020/05/05/xiaomi-mi-commerce-india/

#HTE

Glance, which serves media content, news, and casual games on the lock screen of Android -powered smartphones, has amassed 100 million daily active users, it said today.

The subsidiary of ad-firm InMobi Group reached the milestone in 21 months in what appears to be the shortest duration for any popular internet service to gain their first 100 million daily active users, said Naveen Tewari, founder and chief executive of InMobi Group, in an interview with TechCrunch.

Glance uses AI to offer personalized experience to its users. The service replaces the otherwise empty lock screen with locally relevant news, stories, and casual games. Late last year, InMobi acquired Roposo, a Gurgaon-headquartered startup, that has enabled it to introduce short-form videos on the platform.

“Introducing short-form videos and games on Glance has helped us increase the engagement level. About 25% of our users actively play games on Glance,” said Tewari. The firm is now working to make these short-form videos available in many local languages. (You can also try the service on your mobile web browser or through its preview app on Google Play Store.)

Glance ships pre-installed on several smartphone models. InMobi Group maintains tie-ups with nearly every top Android smartphone vendor including Xiaomi, the top player in India, and Samsung.

But users can easily disable the service, said Tewari, adding that the 100 million users the firm is reporting today are those who consciously engage with content on Glance. Users spend about 25 minutes consuming content on Glance each day, he said.

Sitting on the lock screen, perhaps the most coveted real estate on a smartphone to reach a user, has allowed Glance to deliver any information to a very large number of users in a short time. Tewari said more than 50 million users reacted to Glance informing them about India’s Prime Minister Narendra Modi’s speech last month surrounding the lockdown in the country, for instance.

“We are not just a short-form video platform. We are not just a gaming platform nor one that serves just news. Given where we sit, we cater to nearly everything that is out there across the world. So everyone has something to consume,” he said.

The service is currently available in India, its biggest market with more than 80 million users, Indonesia, Malaysia, Thailand, and the Philippines. Tewari said the firm plans to roll out Glance across the globe in the next two years.

Glance, which raised $45 million last year, is currently not monetizing its users. Tewari said he has experimented with a few ideas, but won’t make any push on this front for another one to two quarters.

https://techcrunch.com/2020/05/05/inmobis-glance-tops-100-million-daily-active-users-in-21-months/

#HTE

Ninja Van, a Singapore-based logistics startup, has secured an additional $279 million in fresh funding as it works to scale its operations to keep up with the surge in e-commerce deliveries in six Southeast Asian countries.

Europe’s GeoPost, Facebook co-founder Eduardo Saverin’s B Capital Group, Monk’s Hill Ventures, Carmenta, Golden Gate Ventures Growth Fund, Intouch Holding, Grab, and two sovereign wealth funds put money in the six-year old startup’s Series D financing round.

The startup, which has raised about $400 million to date, did not disclose its valuation — but an analysis of an early tranche of this round coupled with today’s announcement suggests that Ninja Van is now valued at about $750 million.

Ninja Van claims it delivers more than a million packages across Singapore, Malaysia, the Philippines, Indonesia, Thailand, and Vietnam. It works with several major e-commerce firms including Shopee, Alibaba’s Lazada, Indonesia’s Tokopedia.

In a statement, Ninja Van said it planned to use the fresh capital to make further inroads into the business-to-business sector, while also growing its other existing services.

https://techcrunch.com/2020/05/04/singapores-logistics-startup-ninja-van-raises-279m/

#HTE

E-commerce firms Amazon, Flipkart, and ride-hailing giants Ola and Uber are partially resuming their services in India after Prime Minister Narendra Modi’s government eased some restrictions late last week to revive economic activity that’s been stalled since the stringent stay-at-home orders were ordered across the country in late March.

The companies said in their statements that they were resuming services in green and orange zones, districts that have seen less severe outbreak of the coronavirus, across the country.

Amazon, Flipkart, Snapdeal, and Paytm Mall have resumed accepting — and delivering — orders containing non-essential items (the government has classified essential items as grocery and hygiene products), and Uber and Ola will resume their cab rides in the green and orange zones.

Those living in the red zone and other areas that are even more impacted with the coronavirus’ outbreak will continue to be bereft of the aforementioned firms’ extended services, the companies said.

All of these firms are also taking additional precautions to ensure safety of their delivery and driver partners and that of customers, they said.

Even those living in orange and green zones might be deprived of the extended services as some state governments in India have imposed stricter rules than the federal government and are imposing their own guidelines locally. Additionally, Ola and Uber can’t take their passengers to red zones, and Flipkart and Amazon expect to face disruptions as some of their sellers and warehouses are located in the red zone.

India, which introduced the nationwide lockdown in late March, has extended its lockdown by two weeks from May 4 but relaxed some restrictions. The March’s announcement forced Ola and Uber to suspend much of their services, and Amazon and Flipkart rushed to only serve orders with essential items.

Last month, New Delhi said it would allow e-commerce firms to resume to their full capacity, but it later withdrew the direction after local retail bodies expressed concerns that the move would create a competitive disadvantage for brick and mortar stores.

Research firm Forrester told TechCrunch last month that e-commerce firms had lost more than $1 billion in potential sales in three weeks of lockdown.

The coronavirus outbreak has severely disrupted several businesses. India, the world’s second largest smartphone market, did not sell any handset units last month, research firm Counterpoint said. Smartphones are also going back on sale starting today.

In a call with reporters on Monday, Manu Kumar Jain, a VP at Xiaomi and head of the Chinese smartphone maker’s India business, commended New Delhi’s move and said he expects physical retailers to begin operations soon, too. He said he is also hopeful that smartphone factories will resume operations soon.

Some activities such as travel by air, rail and subways remain prohibited throughout the country, regardless of the zone. Schools and colleges, restaurants, shopping malls, cinema theaters also remain closed.

More to follow…

https://techcrunch.com/2020/05/04/amazon-flipkart-ola-and-uber-begin-to-resume-their-services-in-india/

#HTE

Weeks after Facebook invested $5.7 billion in Indian telecom giant Jio Platforms, private equity firm Silver Lake is following suit.

Silver Lake announced on Monday it will be investing 56.56 billion Indian rupees (about $746.8 million) in the top Indian telecom operator Jio Platforms, giving it a valuation of $65 billion.

Reliance Jio, which began its commercial operation in the second half of 2016, upended the local telecom market by offering bulk of 4G data and voice calls for six months to users at no charge. Jio Platforms, a subsidiary of Reliance Industries (India’s most valuable firm by market value), has amassed 388 million subscribers in the period, becoming the nation’s top telecom operator.

“Jio Platforms is one of the world’s most remarkable companies, led by an incredibly strong and entrepreneurial management team who are driving and actualizing a courageous vision. They have brought extraordinary engineering capabilities to bear on bringing the power of low-cost digital services to a mass consumer and small businesses population. The market potential they are addressing is enormous, and we are honored and pleased to have been invited to partner with Mukesh Ambani and the team at Reliance and Jio to help further the Jio mission,” said Egon Durban, co-chief executive and managing partner at Silver Lake, in a statement.

In a statement, Mukesh Ambani, who oversees Reliance Industries, said, “Silver Lake has an outstanding record of being a valuable partner for leading technology companies globally. Silver Lake is one of the most respected voices in technology and finance. We are excited to leverage insights from their global technology relationships for the Indian Digital Society’s transformation.”

In the company’s earnings call last week, Ambani said several firms had expressed interest in buying a stake in Jio Platforms.

More to follow…

https://techcrunch.com/2020/05/03/silver-lake-jio-platforms/

#HTE

An India-based startup that has built a Shopify -like platform for coaching centers to accept fees digitally from students, and deliver classes and study material online has received the nod — and capital — from a number of high-profile investors.

The business-to-business startup, called Classplus, said on Monday that it has raised $9 million in its Series A financing round led by RTP Global, a prolific investor in early stage startups. Existing investors Blume Ventures, Sequoia Capital India’s Surge, Spiral Ventures, and Strive also participated in the round, said the two-and-a-half-year-old startup.

As dozens of firms bet on hundreds of millions of students — and their parents — to embrace digital learning apps, Classplus, also backed by Times Internet, believes that tens of thousands of teachers and coaching centers that have gained reputation in their neighborhoods are here to stay.

“We are serving these hyperlocal tutoring centers that are present in nearly every nook and cranny in India. Anyone who was born in a middle-class family here has likely attended these tution classes,” said Mukul Rustagi, co-founder and chief executive of Classplus, in an interview with TechCrunch.

“These are typically small and medium setups that are run by teachers themselves. These teachers and coaching centers are very popular in their locality. They rarely do any marketing and students learn about them through word-of-mouth buzz,” he said.

Rustagi described Classplus as “Shopify for coaching centers.” Like Shopify, the service does run a marketplace that offers discoverability to these teachers or coaching centers. Instead, it offers a way for these teachers to leverage its tech platform to engage with customers (in this case, students).

Classplus has on-boarded more than 3,500 coaching centers on its platform, said Rustagi, more than 500 of which started using the service in the month of April after Prime Minister Narendra Modi’s government ordered to shut down schools and other public gatherings in a bid to curb the spread of the coronavirus disease.

Coaching centers use Classplus to digitally communicate with students, deliver video classes and other study material, and accept payments. These coaching centers can engage with their students through Classplus’ mobile app and the website. “Joining the platform is as easy as signing up for a team collaboration app. The whole process takes less than 30 minutes,” said Rustagi.

“According to the Global Teacher Status Index by the Varkey foundation in 2018, India was among the top-10 in the world in respecting teachers, though was in the last-10 in paying them. Classplus is liquidating this imbalance by empowering tutors with full-stack mobile solutions, while maintaining and further improving the high reputation of tutors. We are happy to back the company with this important mission, and have Classplus as our first edutech bet in India,” said Kirill Kozhevnikov, a partner at RTP Global, in a statement.

The startup, which employs about 200 people, aims to have 10,000 coaching centers join its platform by the end of the year. It has a sales team and other members in about 70 cities in India currently. Classplus also plans to introduce additional features for coaching centers on its platform.

https://techcrunch.com/2020/05/03/classplus-coaching-centers-teachers-online/