techcrunch

#HTE

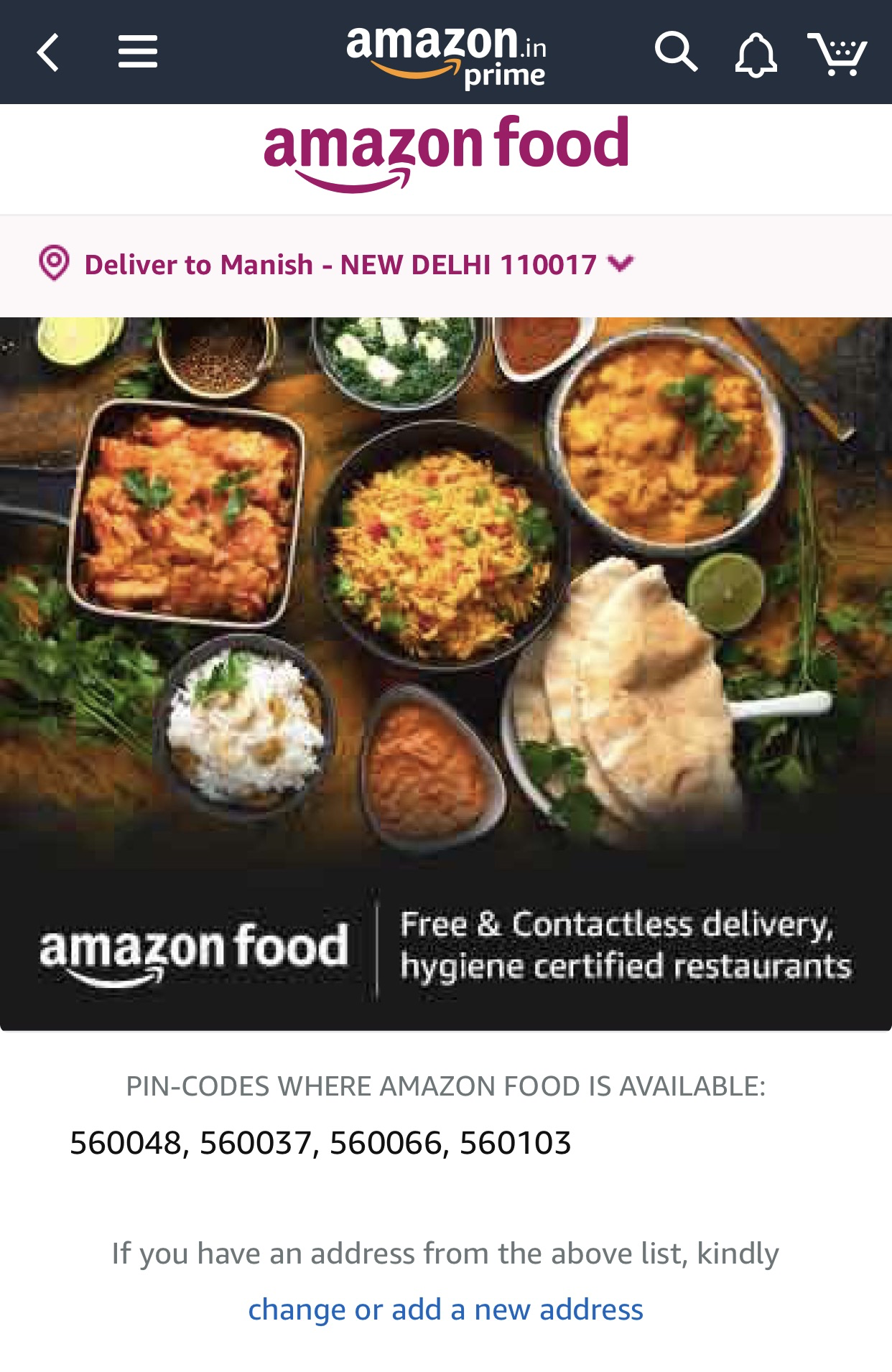

Amazon is joining India’s online food delivery market just as top local players Swiggy and Zomato reduce their workforces to steer through the coronavirus pandemic.

The e-commerce giant, which has invested more than $6.5 billion in India, today launched its food delivery service, called Amazon Food, in select places in Bangalore. The company had originally planned to launch the service in India last year, which it then moved to March but pushed it further amid the nationwide stay-at-home order the Indian government issued in late March.

In the run up to the launch, the e-commerce giant’s employees began testing the food delivery service with select restaurant partners in Bangalore, TechCrunch reported earlier this year.

“Customers have been telling us for some time that they would like to order prepared meals on Amazon in addition to shopping for all other essentials. This is particularly relevant in present times as they stay home safe,” an Amazon spokesperson told TechCrunch.

“We also recognize that local businesses need all the help they can get. We are launching Amazon Food in select Bangalore pin codes allowing customers to order from handpicked local restaurants and cloud kitchens that pass our high hygiene certification bar. We are adhering to the highest standards of safety to ensure our customers remain safe while having a delightful experience,” the spokesperson added.

Amazon’s foray into the food delivery market could create new challenges for Prosus Ventures -backed Swiggy, and Zomato, a 11-year-old startup that acquired Uber’s Eats business in India in January this year.

Both the startups, having raised more than $2 billion together, are still not profitable and are losing more than $15 million each month to acquire new customers and sustain existing ones.

Anand Lunia, a VC at India Quotient, said earlier this year that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform as otherwise most of their customers can’t afford them.

Figuring out a path to profitability is especially challenging in India as unlike in the developed markets such as the U.S., where the value of each delivery item is about $33; in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

But it’s an especially challenging time for Zomato and Swiggy . In the last one month, Swiggy has let go more than 2,100 employees and Zomato has eliminated about 520 jobs at the company as many people become cautious about ordering food online amid the coronavirus outbreak. Both the startups today are seeing fewer than 1 million orders on their respective platforms, down from nearly 3 million they were each processing earlier this year.

Swiggy has additionally scaled down its cloud kitchen operations and some other adjacent businesses. The Bangalore-based startup today began delivering alcohol in Ranchi, a city in the state of Jharkhand. Zomato said today that it will also offer alcohol delivery in Ranchi starting later today. The startups have also started to delivery grocery items in recent weeks.

More to follow…

https://techcrunch.com/2020/05/21/amazon-launches-food-delivery-service-in-india/

#HTE

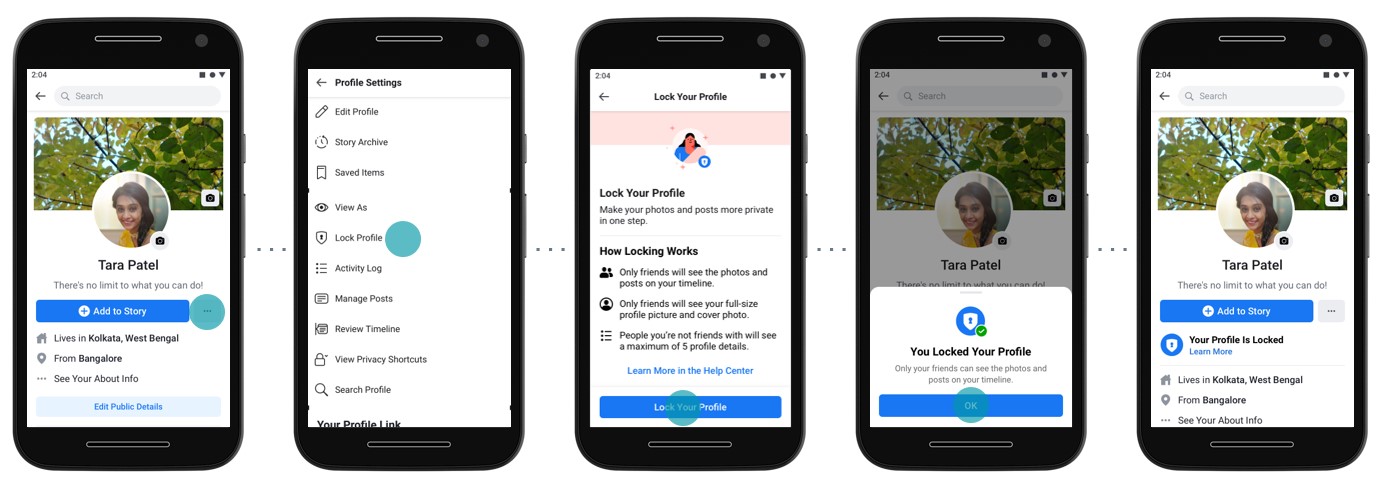

Facebook has rolled out a new safety feature in India that will enable users to easily lock their account so that people they are not friends with on the platform cannot view their posts and zoom into and download their profile picture and cover photo.

The feature is especially aimed at women to give them more control over their Facebook experience, the company said. “We are deeply aware of the concerns people in India, particularly women, have about protecting their online profile,” said Ankhi Das, Public Policy Director at Facebook India, in a statement.

Locking the profile applies multiple existing privacy settings and several new measures to a user’s Facebook profile in a few taps, the company said. Once a user has locked their account, people they are not friends with will no longer be able to see photos and posts — both historic and new — and zoom into, share, and download profile pictures and cover photos.

“We have often heard from young girls that they are hesitant to share about themselves online and are intimidated by the idea of someone misusing their information. I am very happy to see that Facebook is making efforts to learn about their concerns and building products that can give them the experience they want. This new safety feature will give women, especially young girls a chance to express themselves freely,” said Ranjana Kumari, Director at New Delhi-based women advocacy group Centre for Social Research, in a statement.

A user can lock the account by tapping on More under their name, then tapping the Lock Profile button and the confirmation button that prompts afterward.

Prior to Thursday’s announcement, this feature was available to users in Bangladesh, a Facebook spokesperson told TechCrunch.

The new feature appears to be an extension of a similar effort Facebook made in 2017 in India to combat catfishing. That feature, called Profile Picture Guard, allowed users to protect their profile picture from being zoomed into and shared by their friends and those not in the friend list.

https://techcrunch.com/2020/05/21/facebooks-new-safety-feature-for-women-in-india-easily-lock-the-account-from-strangers/

#HTE

Chinese robots will soon be seen roaming a number of warehouse floors across North America. Geek+, a well-funded Chinese robotics company that specializes in logistics automation for factories, warehouses and supply chains, furthers its expansion in North America after striking a strategic partnership with Conveyco, an order fulfillment and distribution center system integrator with operations across the continent.

Geek+ is seizing a massive opportunity in replacing repetitive warehouse work with unmanned robots, a demand that has surged during the coronavirus outbreak as logistics services around the world face labor shortage, respond to an uptick in e-commerce sales, and undertake disease prevention methods.

The partnership will bring Geek+’s autonomous mobile robots, or ARMs, to Conveyco’s clients in retail, ecommerce, omnichannel and logistics across North America. The deal will give a substantial boost to Geek’s overseas distribution while helping Conveyco to “improve efficiency, provide flexibility, and reduce costs associated with warehouse and logistics operations in various industries,” the partners said in a statement.

Beijing-based Geek+ so far operates 10,000 robots worldwide and employs some 800 employees, with offices in China, Germany, the U.K, the U.S., Japan, Hong Kong and Singapore. Some of its clients include Nike, Decathlon, Walmart and Dell.

Since founding in 2015, the company has raised about $390 million through five funding rounds, according to public data collected by Crunchbase, including a colossal $150 million round back in 2018 which it claimed was the largest-ever funding round for a logistics robotics startup. It counts Warburg Pincus, Vertex Ventures and GGV Capital among its list of investors.

https://techcrunch.com/2020/05/20/geek-plus-china-brings-warehouse-robots-to-us/

#HTE

Ola said on Wednesday it is cutting 1,400 jobs in India, or 35% of its workforce in the home market, as the ride-hailing firm works to reduce its expense to steer through the coronavirus pandemic that has severely impacted mobility companies in the country.

Bhavish Aggarwal, co-founder and chief executive of Ola, shared the job elimination update with the team in an email today, in which he also revealed that the company’s revenue had dropped by 95% in the last two months as India enforced a stay-at-home order for its 1.3 billion citizens in late March.

An Ola spokesperson told TechCrunch that only employees working in mobility and food operations were impacted and that the job cuts were limited to teams in India. Ola Electric, a separate entity of the ride-hailing firm, remains unaffected of the layoffs.

“We had all hoped in the beginning that this would be a short-lived crisis and that its impact would be temporary. Over the past couple of months, all members of our extended leadership team have taken significant salary cuts to be able to help the organization delay tougher people decisions as we waited for the situation to evolve. But unfortunately, it’s not been a short crisis,” he wrote in the email, which the company has since published on its blog.

“And the prognosis ahead for our business is very unclear and uncertain. It is going to take a long time for people to go out and about like before. With more companies preferring to have a large number of employees work from home, air travel limited to essential trips and vacations being put off for better times, the impact of this crisis is definitely going to be long-drawn for us. The world is not going to revert to the pre-COVID era anytime soon,” he added.

The employees who are being let go will be provided with three months of salary as well as insurance coverage for them and their parents, healthcare and emotional support until the end of the year, said Aggarwal.

India announced a lockdown in late March that shut all public transportation services across the country. In recent weeks, New Delhi has eased some restrictions and both Ola and Uber have resumed their services in most parts of the country except those where concentration of coronavirus cases is very high. As of today, Ola is operational in more than 160 cities across the country.

Ola is the latest company in India to enforce reduction in its workforce. Uber let go about 500 employees in India as part of its first wave of job cuts earlier this month, as first reported by Indian news outlet Entrackr. It’s unclear how its most recent layoffs announcement impacts its teams in India.

Food delivery startups Swiggy and Zomato, both of which are also facing severe disruptions due to the spread of the infectious disease, have together eliminated about 2,600 jobs (with 2,100 in Swiggy alone) in their companies in recent weeks.

Travel and hospital firms such as Ixigo, MakeMyTrip, and Oyo have also cut several jobs in recent months as their revenues drop significantly.

A person familiar with the matter told TechCrunch that Ola continues to hire for new roles in R&D and other tech departments and Ola Electric has also made several new hires in recent months.

More to follow…

https://techcrunch.com/2020/05/20/indian-ride-hailing-firm-ola-cuts-1400-jobs/

#HTE

As investors get cautious about writing new checks to early stage startups in India amid the coronavirus outbreak, AngelList’s head in India is betting that this is the right time to back young firms.

On Wednesday, Utsav Somani announced iSeed, a micro VC fund to back up at least 30 startups over the course of two years. iSeed, which is not affiliated with AngelList, is Somani’s maiden venture fund.

In an interview with TechCrunch, Somani said he would write checks of $150,000 each to up to 35 early-stage startups in any tech category and enable his portfolio firms’ access to global investors and their knowledge pool. The fund will not participate in a startup’s follow-on rounds.

iSeed counts a range of high-profile investors, including Naval Ravikant and Babak Nivi, co-founders of AngelList, who are some of the biggest backers of the fund.

Others include founders of Xiaomi, Jake Zeller, a partner at AngelList and Spearhead, Sheel Mohnot, general partner at 500 Fintech, Brian Tubergen of CoinList, Deepak Shahdadpuri, managing director at DST Global, and Kavin Bharti Mittal of Hike.

AngelList launched syndicates program in India in 2018. The platform has been used for 140 investments in India since, including over 20 follow-ons in which firms such as Tiger Global, Sequoia Capital, Ribbit Capital participated.

Somani has also been an angel investor in more than a dozen startups including BharatPe, a firm that it is helping small businesses accept online payments and access working capital, and Jupiter, a neo-bank.

“I like the work AngelList India and Utsav have done since the launch. He brings energy, access and judgement to the table — the things to look for in a first-time fund manager,” said Ravikant in a statement.

Micro VCs is becoming a popular trend in the United States. Ryan Hoover of ProductHunt, for instance, maintains Weekend Fund. Somani said he has appreciated how others have been able to institutionalize the angel investing practice. According to Crunchbase, U.S. investors raised 148 sub-$100 million VC funds in 2018.

Running a micro-fund by leveraging AngelList’s infrastructure has also eased the burden starting such a venture creates for an investor, he said.

Indian startups could use any fund that backs early startups. Early-stage firms have consistently struggled to find enough backers in India, according to data from research firm Tracxn .

And that struggle is now common across the industry. More than two-thirds of startups in the country today are on the verge of running out of all their money in less than three months, according to a survey conducted by industry body Nasscom.

Somani said he is optimistic that great companies will continue to be born out of tough times. He said even his investors were aware of the pandemic and still stood by the fund.

“If you look at the market, we are seeing a number of layoffs. These are the people who would be creating jobs for others in the years to come. Entrepreneurship might be the only option for them.

https://techcrunch.com/2020/05/19/angellist-india-head-utsav-somani-launches-micro-vc-fund-to-back-30-early-stage-startups/

#HTE

Khatabook, a startup that is helping small businesses in India record financial transactions digitally and accept payments online with an app, has raised $60 million in a new financing round as it looks to gain more ground in the world’s second most populous nation.

The new financing round, Series B, was led by Facebook co-founder Eduardo Saverin’s B Capital. A range of other new and existing investors, including Sequoia India, Partners of DST Global, Tencent, GGV Capital, RTP Global, Hummingbird Ventures, Falcon Edge Capital, Rocketship.vc and Unilever Ventures, also participated in the round, as did Facebook’s Kevin Weil, Calm’s Alexander Will, CRED’s Kunal Shah and Snapdeal co-founders Kunal Bahl and Rohit Bansal.

The one-and-a-half-year-old startup, which closed its Series A financing round in October last year and has raised $87 million to date, is now valued between $275 million to $300 million, a person familiar with the matter told TechCrunch.

Hundreds of millions of Indians came online in the last decade, but most merchants — think of neighborhood stores — are still offline in the country. They continue to rely on long notebooks to keep a log of their financial transactions. The process is also time-consuming and prone to errors, which could result in substantial losses.

Khatabook, as well as a handful of young and established players in the country, is attempting to change that by using apps to allow merchants to digitize their bookkeeping and also accept payments.

Today more than 8 million merchants from over 700 districts actively use Khatabook, its co-founder and chief executive Ravish Naresh told TechCrunch in an interview.

“We spent most of last year growing our user base,” said Naresh. And that bet has worked for Khatabook, which today competes with Lightspeed -backed OkCredit, Ribbit Capital-backed BharatPe, Walmart’s PhonePe and Paytm, all of which have raised more money than Khatabook.

The Khatabook team poses for a picture (Khatabook)

According to mobile insight firm AppAnnie, Khatabook had more than 910,000 daily active users as of earlier this month, ahead of Paytm’s merchant app, which is used each day by about 520,000 users, OkCredit with 352,000 users, PhonePe with 231,000 users and BharatPe, with some 120,000 users.

All of these firms have seen a decline in their daily active users base in recent months as India enforced a stay-at-home order for all its citizens and shut most stores and public places. But most of the aforementioned firms have only seen about 10-20% decline in their usage, according to AppAnnie.

Because most of Khatabook’s merchants stay in smaller cities and towns that are away from large cities and operate in grocery stores or work in agritech — areas that are exempted from New Delhi’s stay-at-home orders, they have been less impacted by the coronavirus outbreak, said Naresh.

Naresh declined to comment on AppAnnie’s data, but said merchants on the platform were adding $200 million worth of transactions on the Khatabook app each day.

In a statement, Kabir Narang, a general partner at B Capital who also co-heads the firm’s Asia business, said, “we expect the number of digitally sophisticated MSMEs to double over the next three to five years. Small and medium-sized businesses will drive the Indian economy in the era of COVID-19 and they need digital tools to make their businesses efficient and to grow.”

Khatabook will deploy the new capital to expand the size of its technology team as it looks to build more products. One such product could be online lending for these merchants, Naresh said, with some others exploring to solve other challenges these small businesses face.

Amit Jain, former head of Uber in India and now a partner at Sequoia Capital, said more than 50% of these small businesses are yet to get online. According to government data, there are more than 60 million small and micro-sized businesses in India.

India’s payments market could reach $1 trillion by 2023, according to a report by Credit Suisse .

https://techcrunch.com/2020/05/19/indias-khatabook-raises-60-million-to-help-merchants-digitize-bookkeeping-and-accept-payments-online/

#HTE

Xiaomi on Tuesday unveiled the global version of MIUI 12, the latest update to its Android -based operating system, for hundreds of millions of smartphones as the Chinese electronics giant pushes to broaden its services ecosystem.

The world’s fourth largest smartphone firm said it is delivering a range of new features to its overseas users with MIUI 12 including a revamped user interface, the ability to cast the phone screen without the need to connect it to a computer, improvement to multitasking support and battery life, and more privacy controls to users.

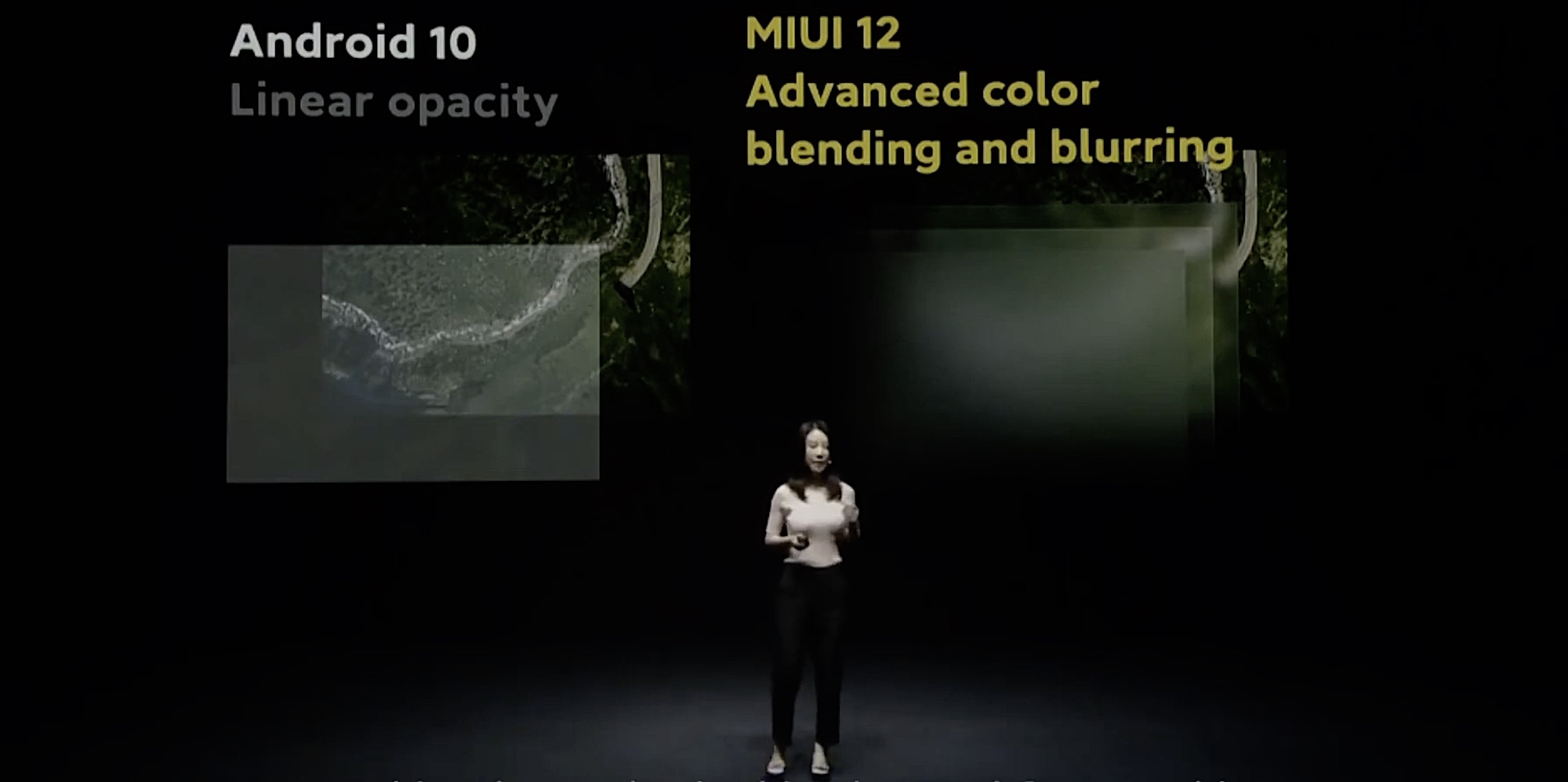

Chief among the new changes is how the software looks. A company executive said animation renders slightly differently after installing MIUI 12, stretching more naturally across the screen — especially on smartphones with rounded corners — as a user taps on an app.

Xiaomi has been able to deliver this graphical improvement thanks to what it calls “kernel-level innovation” that includes a new rendering engine, she said.

“With our rendering, we have enabled color blending and Gaussian blur. You can see various degrees of blurring happening in real time as light penetrates different materials,” explained Louisa Jia, head of marketing and operations of Global MIUI, at an event today.

MIUI 12, which is built atop Android 9 and Android 10 (depending on the device it will be rolled out on), also changes how storage, memory, and power consumption usage are displayed on the phone, making it easier for users to quickly understand the state of their device at a glance.

As part of the new coat of paint, Xiaomi is also deploying dark mode across all third-party apps, including those that have not introduced support for this feature yet.

Support for multitasking is also getting an improvement, popping any additional app on a floating screen that users can move around to any part of the screen and engage quickly without having to switch from the game or other app that they were focusing on. The company said it is also introducing “ultra battery saver” feature that kicks in when the level of phone charge hits 5%. The new feature shuts off every non-essential service to deliver an additional five hours of battery life.

Privacy

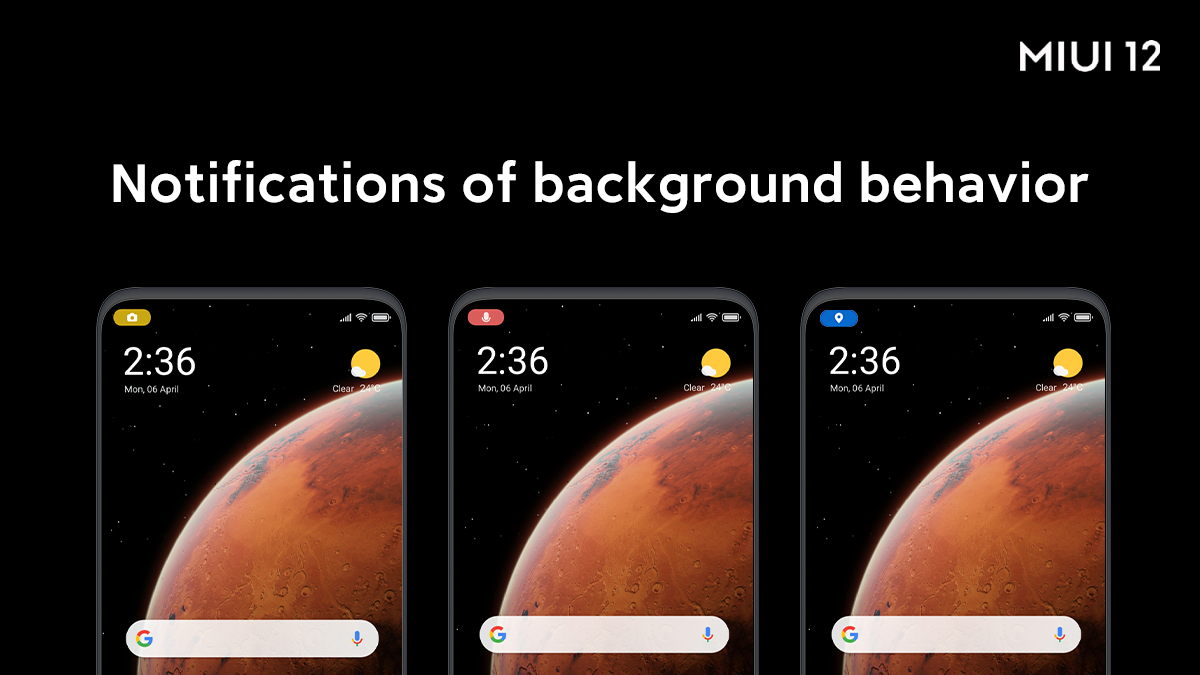

Another interesting feature the company is introducing grants more privacy control to users. MIUI 12 will allow users to easily monitor and restrict apps from using the camera, microphone, location, contacts, storage, call history, and calendar.

Whenever an app uses any of these, a persistent icon appears in the notification bar, tapping which will allow users to see which app is using this data and easily shut that access. Additionally, like with newer versions of Android and iOS, MIUI 12 gives users the ability to determine how often an app can access sensitive personal information.

Xiaomi said with MIUI 12, it is also providing users with the ability to strip off sensitive information such as location data from a photo before they share it with their friends. By default, the new operating system will strip off such data from photos — a feature that privacy advocates have long desired, and business communication app Slack recently introduced to its service.

MIUI 12 will roll out to select smartphones — Mi 9, Mi 9T, Mi 9T Pro, Redmi K20, and Redmi K20 Pro — at the end of June, and dozens of smartphone models including Poco F1 and Redmi 6 that were launched in 2018, “soon afterward,” said Jia. The company said it will make a beta version of MIUI 12 available to users next week for those who don’t want to wait for too long.

More than 300 million smartphones ran MIUI software at the end of last year, Xiaomi revealed in its most recent earnings call in late March. The company has previously stated that it is banking on MIUI to expand its services ecosystem as it looks to cut its financial reliance on sales of gadgets.

https://techcrunch.com/2020/05/19/xiaomi-releases-miui-12-global-update-with-more-privacy-controls-revamped-user-interface/

#HTE

Chinese stocks have seen the highest highs and the lowest lows in recent weeks. While the country suffered the first economic shocks of the novel coronavirus that originated in Wuhan, China’s aggressive containment strategy has allowed the country to reopen in recent weeks, sending stocks at least temporarily to multi-year highs.

Yet, those bold numbers aren’t always what they seem. Multiple scandals in recent weeks have raised serious questions about the state of Chinese accounting practices, and whether stock exchanges are doing enough to protect investors from fraud and scandal.

The most notable story the past few weeks has been the fall of Luckin Coffee, which announced that it may have overstated sales by hundreds of millions of dollars. The company has since fired its CEO and COO, and has declined in value on Nasdaq by nearly 91% from its mid-January peak. The company in a filing with the SEC said that it delayed releasing its financials due to COVID-19 (as well as, just maybe, the fraud investigation as well).

A quieter scandal has been a similar accounting irregularity at TAL Education Group, a China-based tutoring company also traded on Nasdaq. And then overnight, Muddy Waters, the same research firm that first brought potential fraud at Luckin Coffee to light, released a new report on GSX Techedu indicating potential fraud, accusations which were denied by the education company. In its report, Muddy Waters claims that almost 70% of GSX’s students are “bots” and the company is wildly overstating its financials.

Given all these controversies, it looks like Nasdaq is ready to shore up its standards and protect its market for investors.

In new filings with the SEC, Nasdaq proposed amending its ruled to allow for tighter listing standards for companies based in a jurisdiction “that has secrecy laws, blocking statutes, national security laws, or other laws or regulations restricting access to information by regulators of U.S. listed companies.” While the rules would apply equally to all countries with information restrictions, context clearly points at China as being the biggest target. The new rules would require greater financial minimums and accountability standards to qualify for listing.

In addition, Reuters reported overnight that Nasdaq has sent notice to Luckin Coffee that it intends to delist the company’s ADR shares from the exchange. A press contact for Nasdaq did not respond to requests for comment on the news.

Tightening the rules on Nasdaq is ultimately a positive, since strong and transparent markets ultimately encourages more investors to place their money behind companies.

That wasn’t the only positive news for Chinese tech stocks though. The Hang Seng Index, which is the most important barometer in Hong Kong’s finance world, will consider adding companies with dual-class voting structures as well as equities that are located in markets outside of Hong Kong. While there is always grumbling among some investors at these corporate governance structures, American exchanges have mostly acceded to these models in recent years, and many tech IPOs have dual-class voting structures today.

Opening the Hang Seng Index to more locations is and remains complicated. For instance, Alibaba is traded on Nasdaq, but conducted another IPO late last year in Hong Kong that became the largest IPO of 2019, out-fundraising Uber with a haul of $11.2 billion. For some tech companies with global interests, tapping multiple global equities markets is key to gaining access to the most liquidity and market depth possible.

The addition of non-Hong Kong stocks to Hong Kong’s most important stock index in some ways mirrors the inclusion of Chinese stocks in MSCI’s popular emerging markets ETFs in mid-2018. Even as the world puts up more financial borders, companies and their stocks are increasingly global, and indices are following right along with them.

Better accountability and more access makes it a pretty good news day for Chinese stocks. Plus, Luckin Coffee announced last week that it is introducing new lifestyle products, so that might solve the whole damn thing over there quickly, no?

https://techcrunch.com/2020/05/19/following-multiple-scandals-including-luckin-coffee-nasdaq-ready-to-tighten-rules-on-ipo-listings/

#HTE

More than two-thirds of startups in India need to secure additional capital in the coming weeks to steer through the coronavirus pandemic, according to an industry report.

70% of startups in India, home to one of the world’s largest startup ecosystems, have less than three months of cash runway in the bank, and another 22% have enough to barely make it to the end of the year, according to a survey conducted by industry body Nasscom.

Only 8% of startups that participated in Nasscom’s survey said they had enough money to survive for more than nine months, the report published on Tuesday said.

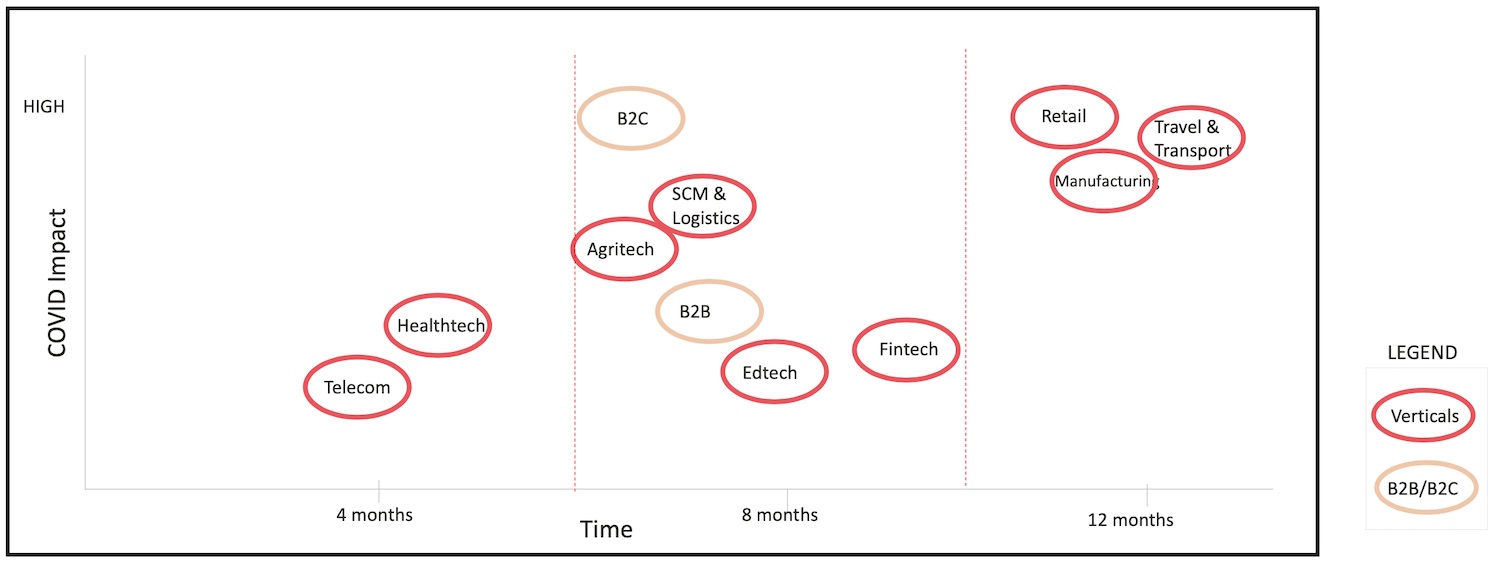

As startups confront unprecedented times, many are thinking of taking dramatic steps to stay afloat. About 54% of some 250 respondents said they were looking to pivot to new business opportunities, and 40% said they wanted to diversify into growth verticals such as healthcare.

The cash crunch comes as investors become cautious about writing new checks to young firms in the country. In an open letter several prominent VC funds warned startups that they may find it especially challenging to raise new capital in the next few months.

For some startups, there are other factors at play, too. More than 69% of business-to-business startups, especially those operating in retail and fintech categories, say in the report that they are facing delays in payments from their clients.

This has left more than 50% of such startups to enforce pay cuts, reduction in marketing spends, and a quarter of them to switch to a lower-cost vendor to save money.

Startups operating in transport and travel sectors are also severely impacted, with 78% of respondents saying they were rethinking their business models and tweaking their products in accordance with the current scenario.

In a call with reporters on Tuesday, executives at Oyo unveiled new steps the budget lodging startup had taken at its hotels to ensure safety for operators and customers. They also said they were hoping that the government would allow more people to travel and stay at hotels again.

More than two-thirds of startups said they were looking for policies that eased regulations and spur government purchases. Many also requested relief in taxations for a few years.

More than two-thirds of Indian startups believe the impact of coronavirus will linger for up to 12 months. (Nasscom)

Earlier this month, India announced a $266 billion stimulus package to help revive the stalled economy. On Saturday, Indian Finance Minister Nirmala Sitharaman said that startups too will be able to access some of this relief — though details remain sparse on how they should go about it.

Since 2017, India’s startup ecosystem has grown consistently. Last year, startups in the country raised a record $14.5 billion.

“Out of the blue, this flourishing growth saga has suddenly been hit by a roadblock… the COVID roadblock. There is no country, business or living being that has not been affected by the COVID pandemic. While governments have been working diligently to protect and save human lives, businesses have been hit and small businesses and start-ups have been the most affected,” said Debjani Ghosh, President of NASSCOM, in the report.

https://techcrunch.com/2020/05/19/70-of-indian-startups-will-run-out-of-money-in-less-than-3-months/

#HTE

TikTok’s parent company ByteDance has added Lingxi, a Beijing-based startup that applies machine intelligence to financial services such as debt collection and insurance sales, to its ever-expanding portfolio of investments.

The AI startup has raised a $6.2 million Series A round co-led by ByteDance and Rocket Internet, the German accelerator that has incubated e-commerce giants Lazada and Jumia. Junsan Capital and GSR Ventures also participated in the round, which officially closed in April.

This marks one of ByteDance’s first investment deals for purely monetary returns, rather than for an immediate strategic purpose. However, with ByteDance’s recent foray into the financial services domain, that relationship could shift over time.

ByteDance as an investor

TikTok’s parent company previously focused narrowly on strategic deals, with the aim of leveraging these smaller startups’ technology, industry know-how, talents and other resources for its own business objectives. The most prominent example is perhaps its acquisition of Musical.ly, through which TikTok gained access to tens of millions of American users and a reputed product team led by founder Alex Zhu.

In 2019, ByteDance’s strategic investment team began its search for venture capital-style funding opportunities. Spearheading the effort is former Sequoia China investor Yang Jie.

There are, however, clear strategic synergies in ByteDance’s first financial investment. The online entertainment giant has already received an insurance broker license and is in the process of obtaining one for consumer finance, according to Lingxi founder and chief executive Zhongpu “Vincent” Xia. When asked if he sees ByteDance eventually deploying Lingxi’s machine intelligence in its future financial services, Xia responded, “Why not?”

ByteDance declined to comment on its entry into the financial sector.

Despite billing themselves as AI-first companies, both ByteDance and Lingxi recognize the essential role of humans before AI reaches the desired level of sophistication. ByteDance today relies on thousands of human auditors to screen content published across its TikTok, Douyin, Today’s Headlines and other apps. Likewise, Lingxi is labor-intensive and manages 200 customer representatives aided by a team of 30 AI experts.

The core of Lingxi is to “augment humans, not to replace them,” said Xia in a phone interview with TechCrunch .

Too big to change

Xia was leading a team of 90 people to work on Baidu’s commercialization of AI when he had an epiphany to do something of his own. He was convinced that AI would enhance humans’ cognitive capability, he said, the same way the steam engine had boosted humans’ physical production a century ago. The Chinese search pioneer has widely been perceived as the poster child of the nation’s booming AI industry because of its early and outsized investment in the technology, but by the end of 2017, Xia felt Baidu’s model of touting AI as a tool wasn’t working.

“We hit a bottleneck. The technology [AI] wasn’t mature enough yet, which means you have to combine it with a big team of people to perform manual tasks like data labeling, so you not only need to hire AI experts, professionals in the business you serve, but also a large number of workers to label data and train the machines,” he said.

Xia is among the industry practitioners who recognize the limitation of machines. While computers can outperform humans in completing repetitive, menial tasks, they remain unreliable in handling complex human emotions and can lead to counterproductive and even detrimental repercussions were they left with full autonomy.

The result of relying completely on machines is “client dissatisfaction,” said Xia. “The client might be very happy for the first few months, but as its business evolves and new needs arise, it will start to realize that the so-called machines are getting dumber and dumber. Artificial intelligence becomes artificial retardedness.”

Lingxi staff at work during the COVID-19 pandemic

Most self-proclaimed AI startups in China make money by selling bots akin to how old-fashioned software was sold with pre-programmed objectives, allowing little room for iteration or upgrade later on. Lingxi, in contrast, is service-based and takes a commission from client revenues.

Take debt collection — Lingxi’s primary focus at this stage — for example. When a client, a financial affiliate of one of China’s biggest internet firms, assigned Lingxi with 1.9 million yuan (about $270,000) worth of debt, the startup’s algorithms first determined how much the machines could handle. It turned out that the robots recovered 1.7 million yuan and left the rest of the cases, which Xia categorized as “irrational and complicated,” to human staff. By Q1 2020, Lingxi was able to achieve 2.5 times the average output of debt collection agencies, and it aims to ramp up the ratio to 4 times by the end of the year.

Human control

Conventionally, a company selling AI tools deals only with the IT department from its clients. Lingxi works with the business department instead. In the client’s eye, the AI startup is no different from a traditional debt collector. In practice, Lingxi is a debt collector with souped-up productivity enabled by computing power.

“The client doesn’t care what tools we use. They care only about the result,” said Xia. “The difference in working with these two departments is that the one in charge of the actual business is result-driven and will give us much stricter KPIs.”

The immediate impact of this model is that the AI-driven vendor must keep improving its algorithms, manually sampling and correcting machine decisions to improve their accuracy. “We might not be making money in the beginning, but over time, our output will certainly surpass those of our competitors.”

The service-oriented approach pushes Lingxi to get its hands dirty, upending the image of tech startups coding away in their sleek and comfortable offices. Its engineers are asked to regularly talk to clients about their real-life business challenges, whereas its customer representatives are required to attend training in how AI works.

“Fusion is what defines our company culture,” said Xia introspectively. “The technical team needs to understand business practices. Vice versa, our business people need to understand technology.”

Coveted sector

It’s not hard to see why Xia chose to target China’s financial services industry. The booming sector is lucrative and tends to be more progressive in embracing technological innovations. Competition in fintech runs high, leveling the playing field for newer entrants against those that are more established.

“There’s a saying in the Chinese tech world that goes: If you can conquer the financial industry, you have conquered the business-to-business world,” said the founder.

The three-year-old startup is targeting 40-80 million yuan ($5.6 million to $11.3 million) in revenue in 2020. It’s one of the few businesses that have, against the odds, thrived under the COVID-19 pandemic because more people are taking out loans to tide the looming economic downturn.

Meanwhile, traditional debt collectors are struggling to hire during city lockdowns due to travel bans across the country, which started to ease in March, while machine-only vendors still fail to satisfy the whole range of client demands. That gave Lingxi a big window to onboard a significant number of new clients, prompting it to hire new staff.

https://techcrunch.com/2020/05/19/bytedance-invests-in-debt-collection-ai-company-lingxi/