asia

#HTE

The Google Pixel 4 and Pixel XL smartphones, that Google just unveiled at a press conference in New York, won’t launch in India, one of the company’s most important overseas markets, the Android-maker said on Tuesday.

The bottleneck lies with Project Soli, a radar-based motion-sensing technology baked into the new Pixel smartphones that relies on using certain frequency bandwidth — 60GHz mmWave. The company failed to secure permission from the local authority in India to use this frequency range, a person familiar with the matter told TechCrunch. You may remember that in the U.S., the FCC approved the commercial usage of Soli earlier this year.

“Google has a wide range of products that we make available in different regions around the world. We determine availability based on a variety of factors, including local trends, and product features. We decided not to make Pixel 4 available in India. We remain committed to our current Pixel phones and look forward to bringing future Pixel devices to India,” a Google spokesperson said in a statement.

The radar sensors on the new Pixel smartphones enable a number of human interactions, Sabrina Ellis, VP of Product Management at Google, said at the event. “For instance, Pixel 4 has the fastest secure face unlock on a smartphone, because the process starts before you have even picked up the smartphone,” she claimed. “Motion sense prepares the camera when you reach for your Pixel 4, so you don’t need to tap the screen,” she added.

The radar sensor also enables other applications such as rejecting a call by just gesturing at the phone, Ellis said.

This is the first time Google has had to skip the launch of a phone in India, the second largest smartphone market and where all the Nexus and Pixel smartphones have launched a few days after their global unveiling.

Not launching the new Pixel smartphones won’t really hurt the company… at least financially speaking. The Pixel smartphones have failed to receive any substantial acceptance in the Indian marker, especially as their prices increased over the years.

Even as 99% of smartphones shipped in India last year ran Android mobile operating system, the vast majority of handsets carried a price tag of $200 or lower, research firm Counterpoint told TechCrunch.

https://techcrunch.com/2019/10/15/google-pixel-4-pixel-4xl-no-india-launch/

#HTE

India’s Flipkart is entering the food retail business as the e-commerce giant looks to expand its reach in the nation, its chief executive said on Tuesday.

Flipkart, which sold majority stake in the company to Walmart for $16 billion last year, has registered an entity called ‘Flipkart Farmermart Pvt Ltd’ — in compliance with local laws — that will focus on food retail, said Kalyan Krishnamurthy, Flipkart Group CEO, in a statement to TechCrunch.

The extended business represents “an important part of our efforts to boost Indian agriculture as well as food processing industry in the country,” he said, adding that the company is already working with hundreds of thousands of small farmers for the business.

In a government filing earlier this week, Flipkart revealed that it has authorized to invest $258 million in the new venture. Krishnamurthy said the company has secured approvals from the board to enter the food retail business.

Indian newspaper Economic Times and outlet CNBC TV 18 first reported about the filing.

“We’re looking forward to invest more deeply in local agri-ecosystem, supply chain and working with lakhs of small farmers, Farmer Producers Organisations (FPOs), food processing industry in India, helping multiply farmers’ income and bring affordable, quality food for millions of customers across the country,” Flipkart chief executive added.

The announcement comes as Flipkart’s chief rival Amazon begins to expand its food retail business in the country. The company has already committed to invest about $500 million in the course of next five years to build its own private label food products and engage with third-party sellers. Two months ago, the company launched its two-hour delivery service called Amazon Fresh in Bangalore.

The Indian government sidestepped the intense opposition to foreign investment in multi-brand retail in 2016 to create a food retailing segment that it said was aimed at creating jobs and helping farmers.

More to follow…

https://techcrunch.com/2019/10/15/walmart-flipkart-food-retail-business/

#HTE

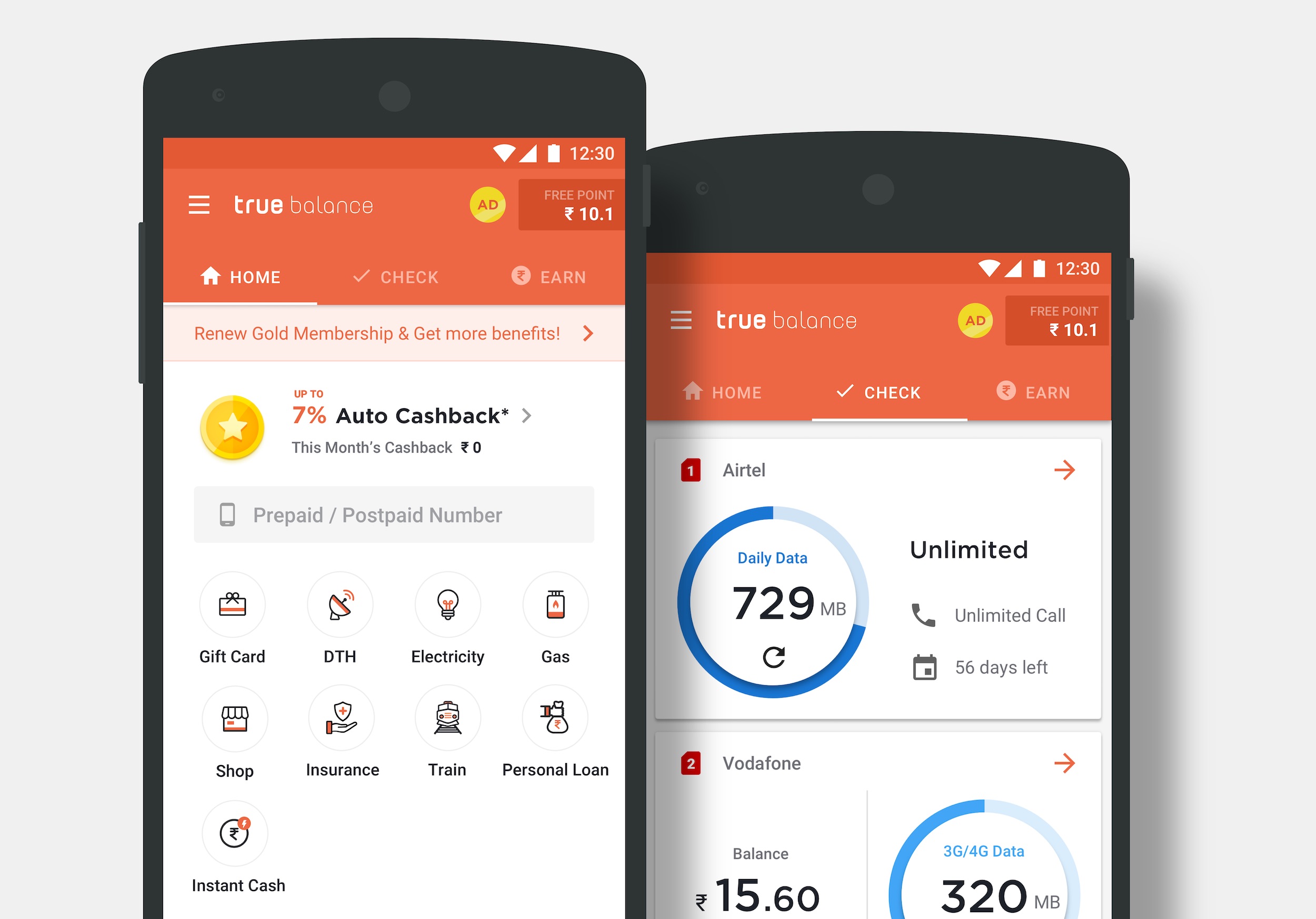

South Korean startup True Balance, which operates an eponymous financial services app aimed at tens of millions of users in small cities and towns in India, has closed a new financing round as it looks to court more first time users in the world’s second largest internet market.

True Balance said on Tuesday that it has raised $23 million in its Series C financing round from seven Korean investors — NH Investment & Securities, IBK Capital, D3 Jubilee Partners, SB Partners, Shinhan Capital, and existing partners IMM Investment, and HB Investment.

TechCrunch reported earlier this year that True Balance — which has raised $65 million to date including the $38 million that it closed in its previous financing round — was looking to raise as much as $70 million for this financing round.

True Balance began its life as a tool to help users easily find their mobile balance, or top up pre-pay mobile credit. But in its four-year journey, its ambition has significantly grown beyond that. Today, it serves as a digital wallet app that helps users pay their mobile and electricity bills, and offer credit to customers so that they can pay later for their digital purchases.

#HTE

Before Google moves to bring its human-sounding robot calling service Duplex to help users automate their interactions with businesses to international markets, an Indian giant is deploying its own solution to get a jumpstart on the local market.

Reliance Jio today unveiled AI-powered Video Call Assistant service that will allow businesses to automate their customer support and other communications. The service, built in collaboration with Radisys, a U.S.-based subsidiary of Reliance Industries, can be accessed via a 4G phone call and does not require installation of any additional app, Jio said.

Executives of Reliance Jio demonstrated the technology on Monday at the third installment of Indian Mobile Congress, similar to but not affiliated with the trade show Mobile World Congress. They said they have already courted a number of customers for this service, including HDFC Bank.

In the demo, a user dials a regular phone number and sees a video chat option. Once tapped, the user is greeted by a pre-recorded video message from a human. To demonstrate the AI’s capabilities, an executive of Reliance Jio asked the bot what was the interest rate on personal loans. The human-looking bot was able to answer the question without any delay.

The company, which became the largest telecom operator in India in three years, is also offering audio and text bot options to brands, executives said. “It may be a large business or small, our bot service is built for all,” one of the two executives said.

#HTE

Indian Railway Catering and Tourism Corporation (IRCTC), a state-run firm that offers train ticketing and catering services in India, more than doubled on its first day of public trading in the best debut for a local firm in two years.

The firm sold 20.1 million shares, or a 12.5% stake on Monday, generating about $91.09 million for the Indian government. IRCTC is the fourth public company to come out of Indian Railways. The Indian government retains about 87.5% stake in the firm.

Shares of IRCTC on BSE and NSE — two stock exchanges in India — rose as much as 132% to Rs 743 ($10.4), compared to its issue price of Rs 320 ($4.5). It ended the day at Rs 728 ($10.2), up 127%, giving the Indian firm a market cap of $1.65 billion. State-run Housing & Urban Development and Cochin Shipyard, debuted two years ago with their offerings oversubscribed 75 times.

IRCTC, which was incorporated in 1999, offers online ticketing, catering, packaged water, and tourism services. The firm holds a monopoly on these train services in India. Catering business alone accounts for about 55% of IRCTC’s revenue.

Rail booking accounts for 24-26% of the online booking industry in India, according to industry estimates. The IRCTC, which introduced online rail booking in 2002, commanded 66% of all online train ticket booking in the fiscal year that ended in March 2018. The firm sold about 675,000 tickets each day in that year. Overall, the company sold $4 billion worth of tickets in that financial year.

Internet ticketing, which accounts for about 12.5% of IRCTC’s revenue, however, has the biggest profit margin — about 35%. Indian Railways, the fourth largest railway network in the world by size, serves more than 23 million people each day. Aloke Bajpai, co-founder and chief executive of travel and hotel booking firm Ixigo, said IRCTC may soon hit $2 billion in market cap. “More power to the strong potential of train travelers in the country.”

Last month, IRCTC introduced a convenience fee on booking of train tickets that could help it add as much as $50 million to its annual revenue, said Mahendra Pratap Mall, Chairman and MD of IRCTC, in an interview. He said online ticketing — especially after the introduction of the fee — is the chief area of growth for the firm.

IRCTC is charging Rs 15 (or 21 cents) for booking a ticket in a non-air conditioned coach, and twice that for air-conditioned compartments.

“Investors have shown tremendous faith in us. It’s a great listing and we are enthused and of course this has put more responsibility on us to do better. We will leave no stones unturned in doing so,” he said.

IRCTC was recently given permit to operate two private routes in India. “So far, the response has been very good. In future, we will like to operate more routes, which would help us increase our revenue,” he said.

IRCTC reported a net profit of $38.2 million in financial year that ended in March 2019, up from $30.9 million a year before. The company, which is debt-free, had a cash reserve of $160 million as of earlier this year.

https://techcrunch.com/2019/10/14/irctc-public-trading-ipo-indian-railways/

#HTE

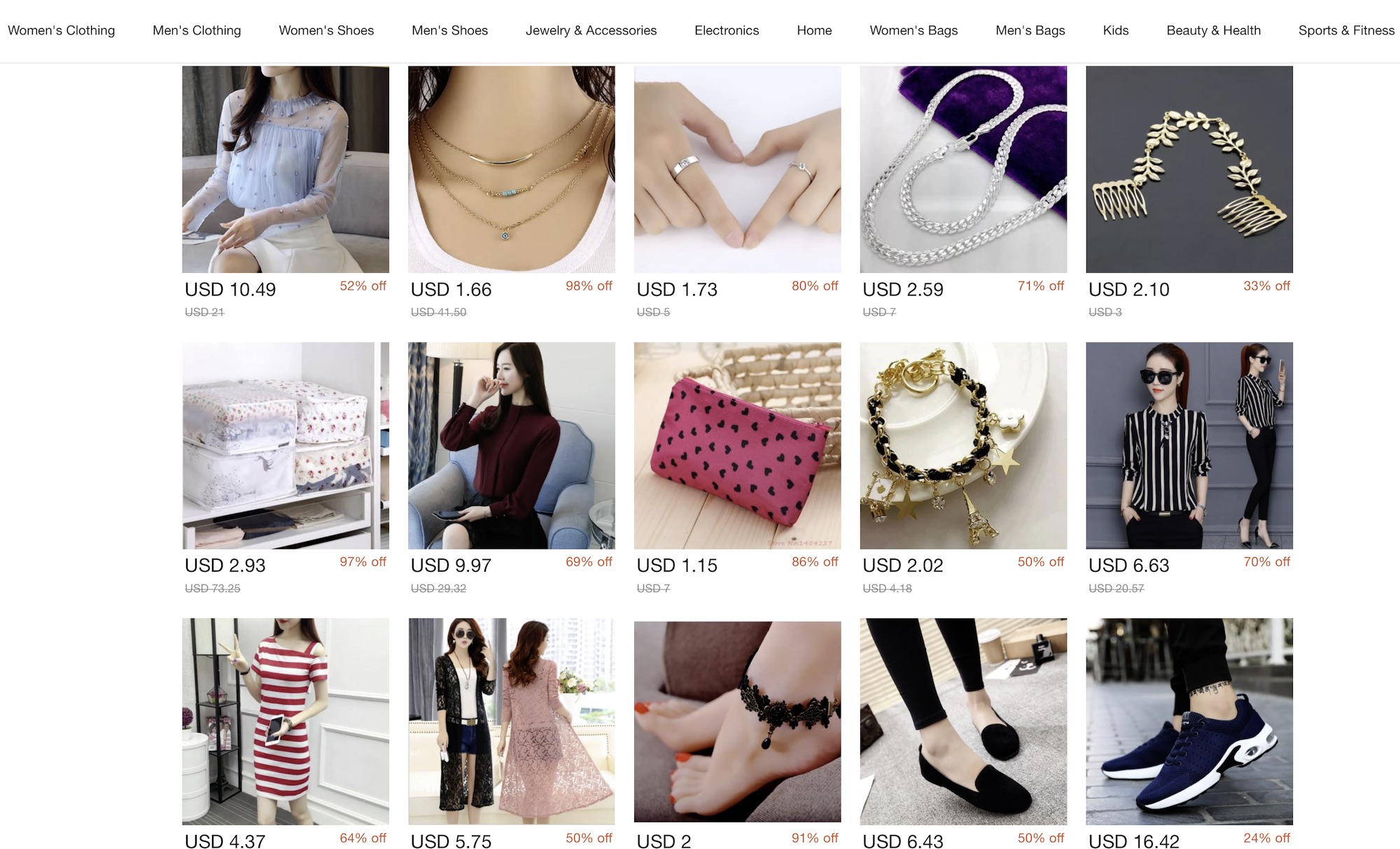

Club Factory, a Chinese e-commerce platform that sells fashion and beauty items and electronics accessories, has raised $100 million in a new financing round as it looks to expand its footprints in India.

The new financing round — Series D — was led by Qiming Venture Partners Bertelsmann, IDG Capital, and” other Fortune 500 companies from the U.S. and Asia,” the five-year-old Hangzhou-headquartered startup said. Club Factory, which raised $100 million in its previous financing round early last year, has raised about $220 million to date.

Club Factory has amassed over 70 million users on its platform, of which about 40 million live in India. The startup cited figures from app analytics firm App Annie to claim that Club Factory is now the third-largest e-commerce platform in India, surpassing once a market-leader Snapdeal.

Club Factory does not charge local sellers any commission fee, which has helped it drive its marketplace. Number of sellers on its platform in India has grown by 10 times in last six months, the startup claimed. The startup, which has about 5,000 sellers in India, plans to double that figure by year-end.

#HTE

Vahdam Teas, an India-based e-commerce startup that sells fresh tea in international markets, has closed a new financing round as it looks to expand its presence in the U.S. and Europe.

The three-year old startup said it has raised $11 million in its Series C financing round. The round, which according to a person familiar with the matter valued the startup at about $40 million, was led by Sixth Sense Ventures. Existing investor Fireside Ventures, which has put money in a number of consumer-facing brands, also participated in the round.

Mankind Group Family office, Infosys co-founder Kris Gopalkrishnan, SAR Group Family office, Zomato co-founder Pankaj Chaddah, and Urmin Group family office also participated in the new financing round. The startup, headquartered in New Delhi and New York, has raised about $16 million to date.

The startup was founded by 28-year-old Bala Sarda, who comes from a tea industry family. Vahdam Teas operates an eponymous e-commerce platform and also works with giants such as Amazon, to sell tea directly to consumers in the U.S., Europe, and other international markets.

Vahdam Teas cuts the middlemen suppliers to reduce the time it takes to ship tea to consumers. “If you look at the supply chain for exporting from India, it’s completely broken. The goods go through distributors, then sold to exporters. Somewhere in the middle, brokers show up, too. Then an importer imports the tea. It all takes months to get a supply cycle to reach consumers. Unlike wine or whiskey, tea is best when it is fresh. Its ingredients lose flavor with time,” he explained.

To address this, Vahdam Teas has built a supply chain network to source tea directly from hundreds of gardens in India. It stores all the goods in its warehouses in New Delhi and then exports directly to its entities in different markets. The faster delivery of tea and better control of the supply chain is one of the key differentiating factors for Vahdam Teas.

Today about 99% of its sales comes from outside of India, said Sarda, who noted that with the new capital the startup would explore expanding its business in India, too.

But much of the fresh capital would be invested in bulking up its supply chain network and set up additional offices in the U.S. and Europe, he said in an interview with TechCrunch earlier this week. The startup also plans to launch new products and enter new markets in South Asia and UAE.

Vahdam Teas also wants to have presence in the offline (brick and mortar) market, and bring its tea to 500-700 stores in the U.S. in the coming months. “We have aspirations to become an omni-channel brand,” he said.

India controls about 25% of tea production worldwide. But Indian brands almost have a “negligible presence” on the world map, said Nikhil Vora, founder and chief executive of Sixth Sense Ventures. “Vahdam is an interesting example of how a traditional business like tea can get disrupted. We’re impressed with the way Bala has sought to target the global markets first and create a brand salience and market innovative ethnic Indian tea flavours,” he added.

Tea is one of the biggest industries for laborers in India. Sarda said the startup donates 1% of its revenue to help these workers educate their children.

https://techcrunch.com/2019/10/10/vahdam-teas-series-c-united-states-expansion/

#HTE

Apple’s decision to greenlight an app called HKmaps, which is being used by pro-democracy protestors in Hong Kong to crowdsource information about street closures and police presence, is attracting the ire of the Chinese government.

An article in Chinese state mouthpiece, China Daily, attacks the iPhone maker for reversing an earlier decision not to allow the app to be listed on the iOS App Store — claiming the app is “allowing the rioters in Hong Kong to go on violent acts” (via The Guardian).

HKmaps uses emoji to denote live police and protest activity around Hong Kong, as reported by users.

The former British colony is a special administrative region of the People’s Republic of China that’s been able to maintain certain economic and and political freedoms since reunification with China — under the one country, two systems principle. But earlier this year pro-democracy protests broke out after the Hong Kong government sought to pass legislation that would allow for extradition to mainland China. It’s policing around those on-going protests that’s being made visible on HKmaps.

The app’s developer denies the map enables illegal activity, saying its function is “for info” purposes only — to allow residents to move freely around the city by being able to avoid protest flash-points. But the Chinese government is branding it “toxic”.

“Business is business, and politics is politics. Nobody wants to drag Apple into the lingering unrest in Hong Kong. But people have reason to assume that Apple is mixing business with politics, and even illegal acts. Apple has to think about the consequences of its unwise and reckless decision,” the China Daily writer warns in a not-so-veiled threat about continued access to the Chinese market.

“Providing a gateway for ‘toxic apps’ is hurting the feelings of the Chinese people, twisting the facts of Hong Kong affairs, and against the views and principles of the Chinese people,” it goes on. “Apple and other corporations should be able to discern right from wrong. They also need to know that only the prosperity of China and China’s Hong Kong will bring them a broader and more sustainable market.”

The article takes further aim at Apple — claiming it reinstated a song which advocates for independence for Hong Kong and had previously been removed from its music store.

We’ve reached out to Apple for comment.

A few days ago the company was getting flak from the other direction as Western commentators piled on to express incredulity over its decision, at the app review stage, not to allow HKmaps on its store. The app’s developer said Apple App Store reviewers had rejected it citing the reasoning as “the app allowed users to evade law enforcement”.

Yet, as many pointed out at the time, the Google-owned Waze app literally describes its function as “avoid police” if you take the trouble to read its iOS listing. So it looked like a crystal-clear case of double standards by Cupertino. And, most awkwardly for Apple, as if the US tech giant was siding with the Chinese state against Hong Kong as concerned residents fight for their autonomy and call for democracy.

We asked Apple about its decision to reject the app at the App Store review stage last week. It did not provide any comment but a couple of days afterwards a spokesman pointed us to an “update” — where the developer tweeted that the iOS version was “Approved, comming soon!” [sic].

At the time of writing the iOS app remains available on the App Store but the episode highlights the tricky trade-offs Apple is facing by operating in the Chinese market — a choice that risks denting its reputation for highly polished corporate values.

The size of the China market is such that just “economical deceleration” can — and has — put a serious dent in Apple’s bottom line. If the company were to exit — or be ejected — from the market entirely there would be no way for it to cushion the blow for shareholders. Yet with a premium brand so bound up with ethical claims to champion and defend fundamental human rights like privacy Apple risks being pinned between a rock and a hard place as an increasingly powerful China flexes more political and economic muscle.

Wider trade tensions between the US and China are also creating further instability, causing major operating headaches for Chinese tech giant Huawei — with the Trump administration pressuring allies to freeze it out of 5G networks and leaning on US companies not to provide services to Chinese firms (leading to question marks over whether Huawei’s smartphones can continue using Google’s Android OS, and suggestions it might seek to deploy its own OS).

The going is certainly getting tougher for tech businesses working from East to West. But it also remains to be seen how sustainable Apple’s West-to-East democratic balancing act can be given heightened and escalating geopolitical tensions.

https://techcrunch.com/2019/10/09/china-attacks-apple-for-allowing-hong-kong-crowdsourced-police-activity-app/

#HTE

Even India’s biggest festive season, featuring blinding marketing blitzkrieg and heavy discounts from Amazon India and Walmart’s Flipkart, has failed to escape the pains of slowing economy.

Online retailers in India sold goods worth $3 billion in the six-day festive sale that concluded last week, growing at an impressive 30% since last year, according to research firm RedSeer. The catch? A year before, the growth rate stood at 93%.

Forrester projected online retailers in India to generate about $4.8 billion in sales between September 25 and October 29. Satish Meena, an analyst at the research firm, said about 80% of these projected sales — $3.84 billion — were expected to occur between September 29 and October 4.

For Amazon India, which has invested more than $5.5 billion in the nation, RedSeer’s findings are more troublesome. According to the research firm’s estimates, Flipkart — together with e-commerce businesses Jabong and Myntra that it owns — commanded 63% of the market share during the festive season. Amazon India settled with just 22%.

An Amazon spokesperson in India declined to comment on the findings, but expressed concerns about the way RedSeer conducts its surveys. The spokesperson said these “speculative reports … lack robust and credible methodology.”

Amazon India did not share its internal findings, but volunteered to cite a Nielsen’s survey of 190,000 users in 50 cities. Per Nielsen, Amazon commanded 51% of all transactions during the festive sales, 42% of all orders, and 45% of all “value.”

The spokesperson added that “this event has been our biggest celebration ever.” The company received orders from 99.4% pin codes in India, and saw the participation of over 65,000 sellers from 500 cities. “Over 88% new customers coming from small towns,” the spokesperson said.

Flipkart did not respond to a request for comment.

Many in India have been watching the e-commerce sales as a test to see if it could kickstart the slowing consumer spending in the nation. The sales, leading up to the Hindu festival of Diwali, has traditionally been the season of lavish and reckless consumption in India.

And for Amazon and Walmart, a lot was riding on this festive season. The first half of this year has been slow for Amazon and Flipkart in India, said Meena. The e-commerce giants were subjected to disruptive changes in local e-commerce policy earlier this year, which forced both to delist hundreds of thousands of goods overnight from their marketplaces.

At a conference last week, U.S. Secretary of Commerce Wilbur Ross expressed concerns over some of India’s recent regulatory changes, saying that India has become one of the most protectionist nations in the world. Indian newspaper The Economic Times reported last week that Amazon had cut investment in its India business by a third this year. Citing the report, Ross said disruptive policy changes influence the way global giants see the Indian market.

But disruptive policies is only one of the causes of concerns for international giants. India’s economy has slowed to a six-year low. Forrester’s Meena said the sales last week was the time when both Amazon and Flipkart could have bounced back. According to industry reports, e-commerce businesses generate nearly a third of their annual sales in India during this festive season.

But even as the growth rate has slowed down, Meena said the fact that both these companies along with other online retailers were able to generate so much sale is good news for them.

“Overall 2019 has been a slow year for e-commerce,” he told TechCrunch in an interview. “Two things are clear, though. One is that there remains a big opportunity for e-commerce in India. Second, consumers from smaller cities and towns are increasing their online spending.”

In the meantime, both Amazon and Flipkart have steered clear of sharing any meaningful internal data. Flipkart said that its marketplace had registered “2X sales growth.” The company said it had seen “3X transaction growth” and electronics grew over “70% from tier 2+ cities.” Amazon said “fashion grew 5X” and beauty items saw “7X” jump in sales.

The companies have never disclosed exact figures, so it is impossible to fathom how one should assess this growth.

https://techcrunch.com/2019/10/09/amazon-walmart-confront-indias-slowing-economy-as-holiday-season-growth-slows/

#HTE

Smartphone maker Vivo, broadcaster CCTV, and internet giant Tencent said today they are suspending all cooperation with the National Basketball Association, becoming the latest Chinese firms to cut ties with the league after a tweet from a Houston Rockets executive supporting Hong Kong’s pro-democracy protesters offended many in the world’s most populous nation.

Vivo, which is a key sponsor for the upcoming exhibition games to be played in Shanghai and Shenzhen this week, said in a statement on Chinese social networking platform Weibo, that it was “dissatisfied” with Rockets General Manager Daryl Morey’s views on Hong Kong.

In a tweet over the weekend, Morey voiced his support for protesters in Hong Kong. He said, “Fight for freedom, stand with Hong Kong.” Even as he quickly moved to delete the tweet and the NBA attempted to smoothen the dialogue, Morey’s views had offended many in China, which maintains a low tolerance for criticism of its political system.

In a statement, the NBA said it was “regrettable” that Morey’s views had “deeply offended many of our friends and fans in China.” This stance from the NBA, which has grown accustomed to seeing its star players speak freely and criticize anyone they wish including the U.S. president Donald Trump, in turn, offended many.

Earlier today, Chinese state broadcaster CCTV said it was also suspending broadcasts of the league’s games to be played in China.

In a statement today, NBA Commissioner Adam Silver tried to steer the league from the controversy. “It is inevitable that people around the world — including from America and China — will have different viewpoints over different issues. It is not the role of the NBA to adjudicate those differences. However, the NBA will not put itself in a position of regulating what players, employees and team owners say or will not say on these issues. We simply could not operate that way,” he said.

China remains a key strategic nation for the NBA. According to official figures, more than 600 million viewers in China watched the NBA content during the 2017-18 season. The league’s five-year partnership with Chinese tech giant Tencent for digital streaming rights of matches is reported to be worth $1.5 billion.

In a statement issued today, Tencent Sports said it was “temporarily suspending” the pre-season broadcast arrangements. Over the weekend, Chinese sportswear maker Li-Ning Company and Shanghai Pudong Development Bank suspended their cooperation with Houston Rockets team.

Users on Twitter reported today that e-commerce giants Alibaba and JD.com appear to have taken a stand, too. Searches in Chinese for “Houston Rockets” and “Rockets”, which previously surfaced NBA franchise products, now return no results.

In an unrelated event, several Chinese services banned an episode of satirical animated show “South Park” last week. In the episode, titled “Band in China”, the show criticized China’s policies on free speech and U.S. corporates’ efforts to bow down to the world’s most population nation to avoid any repercussions.

In a statement on Monday, South Park creators issued a mock apology. They said, “like the NBA, we welcome the Chinese censors into our homes and into our hearts. We too love money more than freedom. Long live the Great Communist Party of China! May this autumn’s sorghum harvest be bountiful! We good now China?”

https://techcrunch.com/2019/10/08/chinese-firms-tencent-vivo-and-cctv-suspend-ties-with-the-nba-over-hong-kong-tweet/