asia

#HTE

ByteDance’s TikTok app, which has gained hundreds of millions of users in India with its short-form videos, is facing criticism in its biggest overseas market after disturbing videos surfaced on the platform.

Phrases such as BanTikTok, DeleteTikTok, and BlockTikTok have trended on Twitter in India in the past three weeks after numerous users expressed disgust over some videos that were circulating on Chinese giant ByteDance’s jewel app.

Users unearthed and shared numerous recent TikTok videos on Twitter that appeared to condone domestic violence, animal cruelty, racism, child abuse and objectification of women.

The backlash has resulted in millions of Indians giving the app a one-star rating on its Google Play Store listing and posting poor reviews that are critical of the app. The app’s overall rating tanked from 4.5 as of earlier this month to as low as 1.2 — until Google intervened.

A Google spokesperson said the company removed millions of negative TikTok reviews that users had left as a corrective action to curb spam abuse. After this correction, TikTok’s rating has recovered slightly to 1.6. At one time, the overall “sentiment” of the app that in part describes a user’s satisfaction with the app based on its reviews, dropped from 86% to 39%, mobile insight firm Apptopia told TechCrunch.

Outrages over an app is not a new phenomenon. In India itself, there have been a handful of cases including an incident when an alleged remark made by Snapchat co-founder upset many Indians, many of whom mistakenly deleted — and left poor ratings for — Snapdeal e-commerce app.

But the new incident, which snowballed after Faizal Siddiqui (a social media influencer) posted a spoof video of an acid attack (for which he has since apologized), has put TikTok’s content moderation efforts on spotlight in India, where its app reached 200 million users late last year.

Maneka Sanjay Gandhi, an Indian politician, argued that TikTok was not following the Indian government’s order after lapses in its content moderation efforts became apparent this month.

In a statement, a TikTok spokesperson said, “keeping people on TikTok safe is a top priority and we make it clear in our Term of Service and Community Guidelines that clearly outlines what is not acceptable on our platform. As per the policy, we do not allow content that risks safety of others, promotes physical harm or glorifies violence against women. The behaviour in question violates our guidelines and we have taken down content, suspended the account, and are working with law enforcement agencies as appropriate.”

But ByteDance did not reveal how many content moderators it had in India and how proactively it removes objectionable videos — or if it does. Last year, TikTok grappled with a similar issue when Madras High Court ordered Google and Apple to block the app in the country over porn and other illegal content. The ban was lifted weeks later.

https://techcrunch.com/2020/05/27/google-removes-millions-of-negative-tiktok-reviews-amid-backlash-in-india/

#HTE

Ola Electric, the EV business that spun out of the ride-hailing giant Ola last year, has acquired an Amsterdam-based electric scooter startup as the Indian firm looks to locally produce and launch its own line of two wheelers as soon as this year.

The Indian firm said Wednesday it had acquired Etergo, a Dutch firm that has built a scooter that uses swappable, high energy battery that delivers a range of up to 240 km (149 miles).

Ola did not reveal the terms of the deal, but Etergo was valued at around $90 million in its previous financing round, a person familiar with the matter told TechCrunch. The six-year-old startup had raised €20.3 million from the market before its acquisition today, according to Crunchbase.

Etergo’s electric-powered two wheeler

The Indian firm, which gained the unicorn status last year when it raised $300 million, said it plans to launch its electric two wheeler in India next year, though TechCrunch understands that the company is internally hoping to reach the milestone by end of this year.

“This acquisition will further bolster Ola Electric’s strong engineering and design capabilities with the Etergo team’s extensive vehicle development experience with leading automotive companies like Tesla, General Motors, Ferrari, Jaguar, and BMW. Etergo’s team will continue to be based out of Amsterdam as they join Ola Electric,” it said in a statement.

More to follow…

https://techcrunch.com/2020/05/26/ola-electric-acquires-etergo-to-launch-own-line-of-electric-two-wheelers-this-year/

#HTE

India said it will publicly release the source code of its contact tracing app, Aarogya Setu, in a relief to privacy and security experts who have been advocating for this ever since the app launched in early April.

Ajay Prakash Sawhney, secretary in the ministry of electronics and information technology, made the announcement on Tuesday, dubbing it as “opening the heart” of Aarogya Setu app, which has amassed over 114 million users in less than two months — an unprecedented scale globally, to allow engineers to inspect and tinker with the code.

The source code of Aarogya Setu’s Android app will be published on GitHub at midnight Tuesday (local time). Sawhney said the government will also offer cash prizes of up to $1,325 to security experts for identifying and reporting bugs and vulnerabilities in the code of Aarogya Setu. (Nearly 98% of Aarogya Setu app users are on Android platform.)

Several privacy and security advocates, as well as India’s opposition party, had urged the government to release the code of the app for public auditing after some alleged lapses in the app were found, which New Delhi dismissed as features at the time.

Sawhney said today’s move should allay people’s concern with the app that is designed to help curb the spread of the coronavirus disease. Earlier this month, Sawhney said the government was not open sourcing Aarogya Setu app as it worried that it would overburden the team, comprising of mostly volunteers, that is tasked to develop and maintain the app.

The ministry said today that two-thirds of Aarogya Setu users had taken the self-assessment test to evaluate their risk of exposure. More than half a million Indians have been alerted to have made contact with someone who is likely ill with the disease, it said.

The app, which uses both Bluetooth and location data to function, has advised more than 900,000 users to quarantine themselves, or test for potential exposure to the disease to date. Almost 24% of them have confirmed to be positive with Covid-19, the ministry said.

“Opening the source code to the developer community signifies our continuing commitment to the principles of transparency and collaboration,” the ministry of electronics and information technology said in a statement. “Aarogya Setu’s development has been a remarkable example of collaboration between government, industry, academia, and citizens.”

Aarogya Setu, unlike the contact tracing technology developed by smartphone vendors Apple and Google, stores certain data in a centralized server. Privacy experts, including researcher Baptiste Robert, had argued that this approach would result in leakage of sensitive details of several Indians if that server was ever compromised.

“Open-sourcing Aarogya Setu is a unique feat for India. No other government product anywhere in the world has been open-sourced at this scale,” said Amitabh Kant, chief executive of government-run think-tank NITI Aayog, in a press conference today.

More to follow…

https://techcrunch.com/2020/05/26/aarogya-setu-india-source-code-release/

#HTE

Meituan’s shares hit a record high on Tuesday, bringing its valuation to over $100 billion.

The Hong Kong-listed giant, which focuses on food delivery with smaller segments in travel and transportation, is the third Chinese firm to reach the landmark valuation. Tencent and Alibaba respectively topped the number back in 2013 and 2014.

Tencent-backed Meituan saw shares rally to HK$138 ($17.8) on Tuesday after it earmarked a smaller-than-projected decrease in revenue during Q1 and a net loss of 1.58 billion yuan ($220 million) after three consecutive profitable quarters.

While nationwide lockdowns might have increased the need for food delivery, Chinese consumers have been tightening their belt amid a worsening economy triggered by COVID-19. Overall food delivery transactions slid as a result. Meituan also had to pay incentives to delivery riders who work during the pandemic and subsidies to merchants to keep their heads above the water.

There’s one silver lining: While Meituan’s daily average number of transactions dropped by 18.2% to 15.1 million, the average value per order jumped by 14.4% as delivered meals, which were conventionally seen as a habit for office workers, became normalized among families that stayed at home. In the first quarter, a large number of premium restaurants joined Meituan’s food delivery services, and they could continue to attract bigger ticket purchases in the post-pandemic era.

All in all, though, Meituan executives warned of the uncertainties brought by COVID-19. “Moving on to the remaining of 2020, we expect that factors including the ongoing pandemic precautions, consumers’ insufficient confidence in offline consumption activities and the risk of merchants’ closure would continue to have a potential impact on our business performance.”

https://techcrunch.com/2020/05/25/chinas-food-delivery-giant-meituan-hits-100b-valuation-amid-pandemic/

#HTE

Uber is cutting 600 jobs in India, or 25% of its workforce in the country, it said on Tuesday as it looks to cut costs to steer through the coronavirus pandemic.

The job cuts, which affect teams across customer and driver support, business development, legal, policy, marketing, and finance, are part of the company’s global restructuring that eliminated 6,700 jobs this month.

The American giant, which claimed to be the top cab hailing service in India earlier this year, said it was providing 10 to 12 weeks of salary to the employees who were being let go, in addition to offering them medical insurance for the next six months.

“The impact of Covid-19 and the unpredictable nature of the recovery has left Uber India with no choice but to reduce the size of its workforce. Around 600 full time positions across driver and rider support, as well as other functions, are being impacted. These reductions are part of previously announced global job cuts this month. Today is an incredibly sad day for colleagues leaving the Uber family and all of us at the company. We made the decision now so that we can look to the future with confidence,” said Pradeep Parameswaran, President for Uber’s India and South Asia businesses, in a statement through a spokesperson.

“I want to apologise to departing colleagues and extend my heartfelt thanks to them for their contributions to Uber, the riders, and the driver partners we serve in India,” he added.

Uber’s announcement follows a similar cost cutting measures enforced by its local rival Ola, which eliminated 4,000 jobs, or 35% of its workforce last week. Ola said its food delivery unit was one of the key businesses to be affected by the job losses. Uber sold its Indian food delivery business to Zomato earlier this year.

India announced a lockdown in late March that shut down all public transportation services across the country. In recent weeks, New Delhi has eased some restrictions, however, that has enabled both Ola and Uber to resume several of their services — excluding pool rides — in most parts of the country except those where concentration of coronavirus cases is very high.

As in most other parts of the world, the Covid-19 outbreak has disrupted several industries in India including food delivery, hospitality and travel. Food delivery startups Swiggy and Zomato have together eliminated about 2,600 jobs (with 2,100 at Swiggy alone) as many of their existing customers attempt to avoid exposure to the world.

Travel and hospital firms such as MakeMyTrip and Oyo have also cut several jobs or furloughed thousands of employees in recent months as their revenues drop significantly.

https://techcrunch.com/2020/05/25/uber-cuts-600-jobs-in-india/

#HTE

Notion, the fast-growing work collaboration tool that recently hit a $2 billion valuation, said on Twitter Monday that its service is blocked in China.

The productivity app has attracted waves of startups and tech workers around the world — including those in China — to adopt its all-in-one platform that blends notes, wikis, to-dos, and team collaboration. The four-year-old San Francisco-based app is widely seen as a serious rival to Evernote, which started out in 2004.

Notion said it is “monitoring the situation and will continue to post updates,” but the timing of the ban noticeably coincides with China’s annual parliament meeting, which began last week after a two-month delay due to the COVID-19 pandemic. Internet regulation and censorship normally toughen around key political meetings in the country.

Notion could not be immediately reached for comment.

For Notion and other apps that have entered the public eye in China but remained beyond the arm of local laws, a looming crackdown is almost certain. The country’s cybersecurity watchdog could find Notion’s free flow of note-sharing problematic. Some users have even conveniently turned the tool’s friendly desktop version into personal websites. If Notion were to keep its China presence, it would have to bow to the same set of regulations that rule all content creation platforms in China.

Its predecessor Evernote, for example, established a Chinese joint venture in 2018 and released a local edition under the brand Yinxiang Biji, which comes with compromised features and stores user data within China.

Rivalry in work collaboration

Just before its ban in China, Notion surged on May 21 to become the most-downloaded productivity app in the domestic Android stores, according to third-party data from App Annie. The sudden rise appears to be linked to its Chinese copycat Hanzhou (寒舟), which stirred up controversy within the developer community over its striking resemblance to Notion.

In an apologetic post published on May 22, Xu Haihao, the brain behind Hanzhou and a former employee of ByteDance-backed document collaboration app Shimo, admitted to “developing the project based on Notion.”

“We are wrong from the beginning,” wrote Xu. “But I intended to offend nobody. My intention was to learn from [Notion’s] technology.” As a resolution, the developer said he would suspend Hanzou’s development and user registration.

Some of the largest tech firms in China are gunning for the workplace productivity industry, which received a recent boost during the coronavirus crisis. Alibaba’s Dingtalk claimed last August that more than 10 million enterprises and over 200 million individual users had registered on its platform. By comparison, Tencent’s WeChat Work said it had logged more than 2.5 million enterprises and some 60 million active users by December.

https://techcrunch.com/2020/05/24/work-collaboration-unicorn-notion-is-blocked-in-china/

#HTE

Hello and welcome back to TechCrunch’s China Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. It’s been a tumultuous week for Chinese tech firms abroad: Huawei’s mounting pressure from the U.S., a big blow to U.S.-listed Chinese firms, and TikTok’s high-profile new boss.

China tech abroad

Further decoupling

Over the years, American investors have been pumping billions of dollars into Chinese firms listed in the U.S., from giants like Alibaba and Baidu to emerging players like Pinduoduo and Bilibili. That could change soon with the Holding Foreign Companies Accountable Act, a new bill passed this week with bipartisan support to tighten accounting standards on foreign companies, with the obvious target being China.

“For too long, Chinese companies have disregarded U.S. reporting standards, misleading our investors. Publicly listed companies should all be held to the same standards, and this bill makes commonsense changes to level the playing field and give investors the transparency they need to make informed decisions,” said Senator Chris Van Hollen who introduced the legislation.

Here’s what the legislation is about:

1) Foreign companies that are out of compliance with the Public Company Accounting Oversight Board for three years in a row will be delisted from U.S. stock exchanges.

PCAOB, which was set up in 2002 as a private-sector nonprofit corporation overseen by the SEC, is meant to inspect audits of foreign firms listed in the U.S. to prevent fraud and wrongdoing.

The rule has not sat well with foreign accounting firms and their local regulators, so over time PCAOB has negotiated multiple agreements with foreign counterparts that allowed it to perform audit inspections. China is one of the few countries that has not been cooperating with the PCAOB.

2) The bill will also require public companies in the U.S. to disclose whether they are owned or controlled by a foreign government, including China’s communist government.

The question now is whether we will see Chinese companies give in to the new rules or relocate to bourses outside the U.S.

The Chinese firms still have a three-year window to figure things out, but they are getting more scrutiny already. Most recently, Nasdaq announced to delist Luckin, the Chinese coffee challenger that admitted to fabricating $310 million in sales.

Those that do choose to leave the U.S. will probably find a warmer welcome in Hong Kong, attracting investors closer to home who are more acquainted with their businesses. Alibaba, for instance, already completed a secondary listing in Hong Kong last year as the city began letting investors buy dual-class shares, a condition that initially prompted many Chinese internet firms to go public in the U.S.

The long-awaited announcement is here: TikTok has picked its new chief executive, and taking the helm is Disney’s former head of video streaming, Kevin Mayer.

It’s understandable that TikTok would want a global face for its fast-growing global app, which has come under scrutiny from foreign governments over concerns of its data practices and Beijing’s possible influence.

Curiously, Mayer will also take on the role of the chief operating officer of parent company ByteDance . A closer look at the company announcement reveals nuances in the appointment: Kelly Zhang and Lidong Zhang will continue to lead ByteDance China as its chief executive officer and chairman respectively, reporting directly to ByteDance’s founder and global CEO Yiming Zhang, as industry analyst Matthew Brennan acutely pointed out. That means ByteDance’s China businesses Douyin and Today’s Headlines, the cash cows of the firm, will remain within the purview of the two Chinese executives, not Mayer.

Huawei in limbo following more chip curbs

Huawei is in limbo after the U.S. slapped more curbs on the Chinese telecoms equipment giant, restricting its ability to procure chips from foreign foundries that use American technologies. The company called the rule “arbitrary and pernicious,” while it admitted that the attack would impact its business.

Vodafone to help Oppo expand in Europe

As Huawei faces pressure abroad due to the Android ban, other Chinese phone makers have been steadily making headway across the world. One of them is Oppo, which just announced a partnership with Vodafone to bring its smartphones to the mobile carrier’s European markets.

All of China’s top AI firms now on U.S. entity list

The U.S. has extended sanctions to more Chinese tech firms to include CloudWalk, which focuses on developing facial recognition technology. This means all of the “four dragons of computer vision” in China, as the local tech circle collectively calls CloudWalk, SenseTime, Megvii and Yitu, have landed on the U.S. entity list.

China tech back home

China’s new trillion-dollar plan to seize the tech crown (Bloomberg)

China has a new master plan to invest $1.4 trillion in everything from AI to 5G in what it dubs the “new infrastructure” initiative.

Fitbit rival Amazfit works on a reusable mask

The smartwatch maker is eyeing a transparent, self-disinfecting mask, becoming the latest Chinese tech firm to jump on the bandwagon to develop virus-fighting tech.

ByteDance moves into venture capital investment

The TikTok parent bankrolled financial AI startup Lingxi with $6.2 million, marking one of its first investments for purely monetary returns rather than for an immediate strategic purpose.

Bilibili is the new Youtube of China

The once-obscure video site for anime fans is now in the mainstream with a whopping 172 million monthly user base.

Xiaomi’s investment powerhouse reaches 300 companies

It’s part of the smartphone giant’s plan to conquer the world of smart home devices and wearables.

Alibaba pumps $1.4 billion into content and services for IoT

Like Amazon, Alibaba has a big ambition in the internet of things.

https://techcrunch.com/2020/05/24/china-roundup-a-blow-to-us-listed-chinese-firms-and-tiktoks-new-global-face/

#HTE

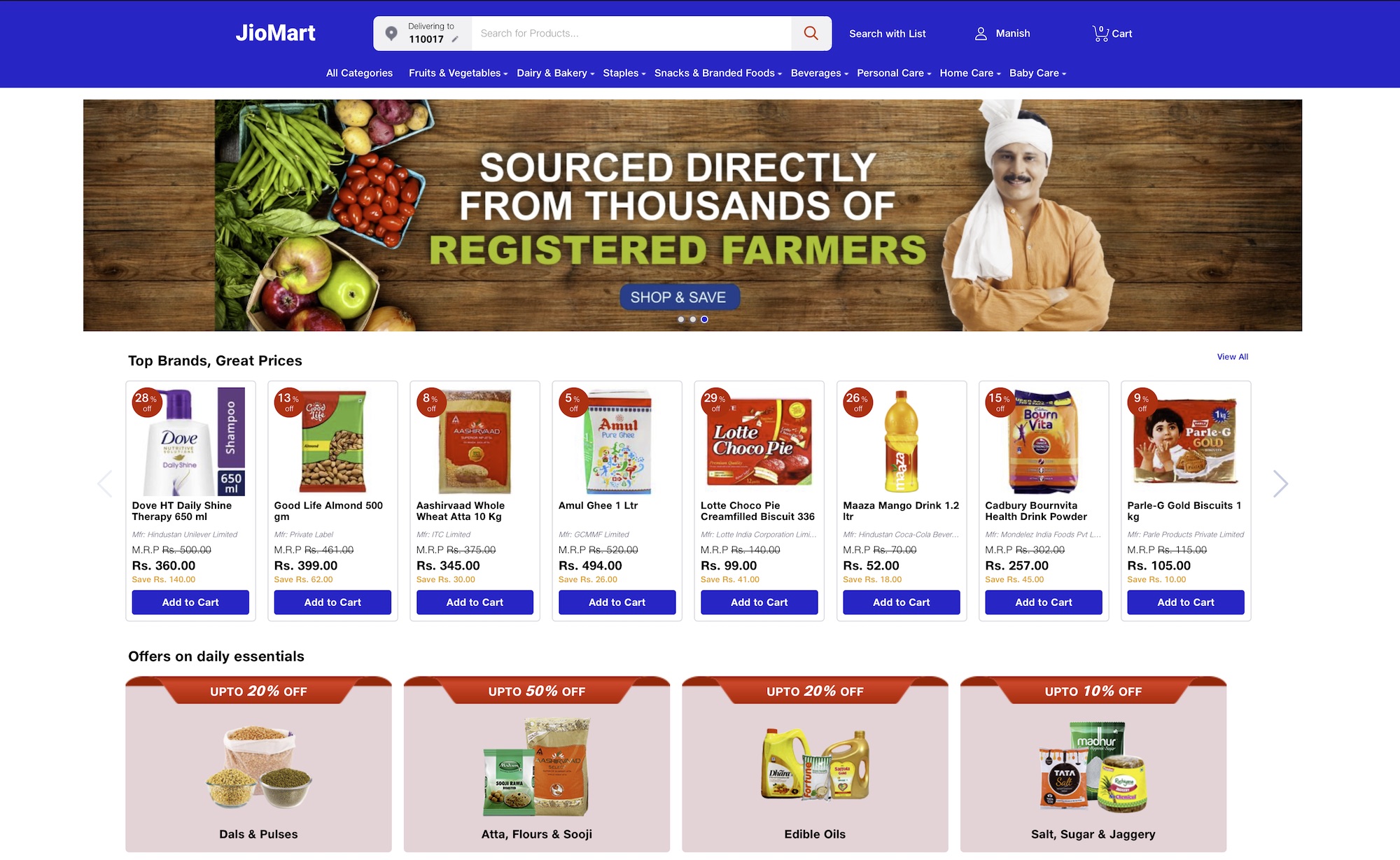

The rationale behind the deluge of dollars flooding into billionaire Mukesh Ambani’s Reliance Jio Platforms is beginning to become more clear as his e-commerce venture JioMart starts rolling out to more people across India.

An e-commerce venture between the nation’s top telecom operator Jio Platforms and top retail chain Jio Retail, JioMart just launched its new website and started accepting orders in dozens of metro, tier 1 and tier 2 cities including Delhi, Chennai, Kolkata, Bangalore, Pune, Bokaro, Bathinda, Ahmedabad, Gurgaon, and Dehradun.

Before the expansion on Saturday, the service was available in three suburbs of Mumbai. The service now includes perishables such as fruits and vegetables, and dairy items in addition to staples and other grocery products as it makes its pitch to Indian households across the country.

Ambani’s Reliance Jio Platforms, which has raised more than $10 billion in the last month by selling a roughly 17% stake, has amassed over 388 million subscribers, more than any other telecom operator in the country.

The money comes as Ambani’s various companies begin entering a market already teeming with fierce competitors like Amazon, Walmart’s Flipkart, BigBasket, MilkBasket, and Grofers.

Earlier this week the American e-commerce giant entered India’s food delivery market to challenge the duopoly of Prosus Ventures-backed Swiggy and Ant Financial-backed Zomato. Amazon is making a massive hiring push in India, and is looking to hire close to 50,000 seasonal workers to keep up with the growing demand on its platform.

Meanwhile, Ambani’s Reliance Retail, founded in 2006, remains the largest retailer in India by revenue. It serves more than 3.5 million customers each week through its nearly 10,000 physical stores in more than 6,500 cities and towns.

JioMart may have Amazon and Flipkart in its sights, but in its current form, however, the company is going to be more of a headache for Grofers and BigBasket, the top grocery delivery startups in India.

Reliance Industries, the most valued firm in India and parent entity of Jio Platforms and Reliance Retail, plans to expand JioMart to more than a thousand districts in a year and also widen its catalog to include electronics and office supplies among a variety of other categories, a person familiar with the matter told TechCrunch. A Reliance Jio spokesperson declined to comment.

The expansion to more cities comes a month after JioMart launched its WhatsApp business account, enabling people to easily track their order and invoice on Facebook -owned service.

Facebook announced it would invest $5.7 billion in India’s Reliance Jio Platforms last month and pledged to work with the Indian firm to help small businesses across the country. JioMart’s WhatsApp account currently does not support the expanded regions.

Mukesh Ambani, India’s richest man and the chairman and managing director of Reliance Industries, first unveiled his plan to launch an e-commerce platform last year. In a speech then, Ambani invoked Mahatma Gandhi’s work and said India needed to fight another fresh battle.

A handful of firms have attempted — and failed — to launch their e-commerce websites over the years in India, where more than 95% of sales still occur through brick and mortar stores. But Ambani is uniquely positioned to fight the duopoly of Amazon and Walmart’s Flipkart — thanks in part to the more than $10 billion in investment dollars the company recently raised from KKR, Facebook, Silver Lake, Vista Equity Partners, and General Atlantic. In addition to scaling JioMart, the fresh capital should also help Ambani repay some of Reliance Industries’ $21 billion debt.

“We have to collectively launch a new movement against data colonization. For India to succeed in this data-driven revolution, we will have to migrate the control and ownership of Indian data back to India — in other words, Indian wealth back to every Indian,” Ambani said at an event attended by Indian Prime Minister Narendra Modi .

https://techcrunch.com/2020/05/23/jiomart-the-e-commerce-venture-by-indias-richest-man-launches-in-additional-cities/

#HTE

Xiaomi, the Chinese comapny famous for its budget smartphones and a bevy of value-for-money gadgets, said in a filing on Thursday that it has backed more than 300 companies as of March, totaling 32.3 billion yuan ($4.54 billion) in book value and 225.9 million yuan ($32 million million) in net gains on disposal of investments in just the first quarter.

The electronics giant has surely lived up to its ambition to construct an ecosystem of the internet of things, or IoT. Most of its investments aim to generate strategic synergies, whether it is to diversify its product offerings or build up a library of content and services to supplement the devices. The question is whether Xiaomi’s hardware universe is generating the type of services income it covets.

Monetize from services

Back in 2013, Xiaomi founder Lei Jun vowed to invest in 100 hardware companies over a five-year period. The idea was to acquire scores of users through this vast network of competitively-priced devices, through which it could tout internet services like fintech products and video games.

That’s why Xiaomi has kept margins of its products razor-thin, sometimes to the dismay of its investees and suppliers. Its vision hasn’t quite materialized, as it continued to drive most of its income from smartphones and other hardware devices. Services comprised 12% of total revenue in the first quarter, although the segment did record a 38.6% increase from the year before.

Over time, the smartphone maker has evolved into a department store selling all sorts of everyday products, expanding beyond electronics to cover categories like stationaries, kitchenware, clothing and food — things one would find at Muji. It makes certain products in-house — like smartphones — and sources the others through a profit-sharing model with third parties, which it has financed or simply partners with under distribution agreements.

Xiaomi’s capital game

Many consumer product makers are on the fence about joining Xiaomi’s distribution universe. On the one hand, they can reach millions of consumers around the world through the giant’s vast network of e-commerce channels and physical stores. On the other, they worry about margin squeeze and overdependence on the Xiaomi brand.

As such, many companies that sell through Xiaomi have also carved out their own product lines. Nasdaq-listed Huami, which supplies Xiaomi’s Mi Band smartwatches, has its own Amazfit wearables that rival Fitbit. Roborock, an automatic vacuum maker trading on China’s Nasdaq equivalent, STAR Market, had been making Xiaomi’s Mi Home vacuums for a year before rolling out its own household brand.

With the looming economic downturn triggered by COVID-19, manufacturers might be increasingly turning to Xiaomi and other investors to cope with cash-flow liquidity challenges.

Along with its earnings, Xiaomi announced that it had bought an additional 27.44% stake in Zimi, the main supplier of its power banks, bringing its total stakes in the company to 49.91%. Xiaomi said the acquisition would boost Xiaomi’s competitiveness in “5G + AIoT,” a buzzword short for the next-gen mobile broadband technology and AI-powered IoT. For Zimi, the investment will likely alleviate some of the financial pressure it’s feeling under these difficult times.

Competition in the Chinese IoT industry is heating up as the country races to roll out 5G networks, which will enable wider adoption of connected devices. Just this week, Alibaba, which has its finger in many pies, announced pumping 10 billion yuan ($1.4 billion) into ramping up its Alexa-like smart voice assistant Genie, which will be further integrated into Alibaba’s e-commerce experience, online entertainment services and consumer hardware partners.

https://techcrunch.com/2020/05/22/xiaomi-investment-portfolio-surpasses-300-companies/

#HTE

Mukesh Ambani’s Reliance Jio Platforms has agreed to sell 2.32% stake to U.S. equity firm KKR in what is the fifth major investment the top Indian telecom operator has secured in just as many weeks.

On Friday, KKR announced it will invest $1.5 billion in the top Indian telecom operator, a subsidiary of India’s most valued firm (Reliance Industries), joining fellow American investors Facebook, Silver Lake, Vista Equity Partners, and General Atlantic that have made similar bets on the Indian firm that has amassed over 388 million subscribers.

The investment from KKR, which has written checks to about 20 tech companies including ByteDance and GoJek to date, values Reliance Jio Platforms at $65 billion.

The announcement today further shows the growing appeal of Jio Platforms, which has raised $10.35 billion in the past month by selling about 17% of its stake, to foreign investors that are looking for a slice of the world’s second-largest internet market.

Ambani, the chairman and managing director of oil-to-telecoms giant Reliance Industries that has poured more than $30 billion to build Jio Platforms, said the company was looking forward to leverage “KKR’s global platform, industry knowledge and operational expertise to further grow Jio.”

An advertisement featuring Bollywood actor Shah Rukh Khan for Reliance Jio (Image: Dhiraj Singh/Bloomberg via Getty Images)

Reliance Jio, which launched in the second half of 2016, upended India’s telecommunications industry with cut-rate data plans and free voice calls. Jio Platforms, a subsidiary of Reliance Industries, operates the telecom venture, called Jio Infocomm, that has become the top telecom operator in India.

Reliance Jio Platforms also owns a bevy of digital apps and services including music streaming service JioSaavn (which it says it will take public), on-demand live television service and payments service, as well as smartphones, and broadband business.

“Few companies have the potential to transform a country’s digital ecosystem in the way that Jio Platforms is doing in India, and potentially worldwide. Jio Platforms is a true homegrown next generation technology leader in India that is unmatched in its ability to deliver technology solutions and services to a country that is experiencing a digital revolution,” Henry Kravis, co-founder and co-chief executive of KKR, said in a statement.

“We are investing behind Jio Platforms’ impressive momentum, world-class innovation and strong leadership team, and we view this landmark investment as a strong indicator of KKR’s commitment to supporting leading technology companies in India and Asia Pacific,” he added. This is the single-largest investment (in equity terms) made from KKR’s Asia private equity business to date.

The new capital should also help Ambani, India’s richest man, further solidify his last year’s commitment to investors when he pledged to cut Reliance’s net debt of about $21 billion to zero by early 2021 — in part because of the investments it has made to build Jio Platforms. Its core business — oil refining and petrochemicals — has been hard hit by the coronavirus outbreak. Its net profit in the quarter that ended on March 31 fell by 37%.

In the company’s earnings call last month, Ambani said several firms had expressed interest in buying stakes in Jio Platforms in the wake of the deal with Facebook . Recent investments also pave the way for an initial public offering of Jio, which could happen within five years.

More to follow…

https://techcrunch.com/2020/05/21/kkr-invests-1-5-billion-in-indias-reliance-jio-platforms/