asia

#HTE

Apple will roll out a range of new features and improvements that are aimed at users in India, China and other international markets with its yearly updates to iOS, iPadOS, and macOS operating systems, it unveiled today.

iOS 14, which is rolling out to developers today and will reach general users later this year, introduces new bilingual dictionaries to support French and German; Indonesia and English; Japanese and Simplified Chinese; and Polish and English. For its users in China, one of Apple’s biggest overseas markets, the iPhone-maker said the new operating system will introduce support for Wubi keyboard.

For users in India, Apple is adding 20 new document fonts and upgrading 18 existing fonts with “more weights and italics” to give people greater choices. For those living in the world’s second largest internet market, Mail app now supports email addresses in Indian script.

Apple said it will also deliver a range of additional features for India, building on the big momentum it kickstarted last year.

Messages now feature corresponding full-screen effects when users send greetings such as “Happy Holi” in one of the 23 Indian local languages.

More interestingly, iOS 14 will include smart downloads, which will allow users in India to download Indian Siri voices and software updates as well as download and stream Apple TV+ shows over cellular networks — a feature that is not available elsewhere in the world.

The feature further addresses the patchy networks that are prevalent in India — despite major improvements in recent years. Last year, Apple beamed a feature for users in India that enabled users in the nation to set an optimized time of the day in on-demand streaming apps such as Hotstar and Netflix for downloading videos.

New improvements further shows Apple’s growing focus on India, the world’s second largest smartphone market. Apple chief executive Tim Cook said earlier this year that the company will launch its online store in the country later this year, and open its first physical store next year. A source familiar with the matter told TechCrunch last month that the global pandemic had not affected the plan.

iOS 14 will also allow users in Ireland and Norway to utilize the autocorrection feature as the new update adds support for Irish Gaelic and Norwegian Nynorsk. And there’s also a redesigned Kana keyboard for Japan, which will enable users there to type numbers with repeated digits more easily on the redesigned Numbers and Symbols plane.

All the aforementioned features — except email addresses in Indian script in Mail and smart downloads for users in India — will also ship with iPadOS 14. And the aforementioned new bilingual dictionaries, new fonts for India, and localized messages are coming to macOS Big Sur.

Additionally, Apple says on the desktop operating system it has also enhanced predictive input for Chinese and Japanese results in more accurate and contextual predictions.

https://techcrunch.com/2020/06/22/apple-unveils-ios-14-and-macos-big-sur-features-for-india-china-and-other-international-markets/

#HTE

The encrypted instant messenger Telegram said on Monday it’s ramping up efforts to develop anti-censorship technologies serving users in countries where it is banned or partially blocked, including China and Iran.

“Over the course of the last two years, we had to regularly upgrade our ‘unblocking’ technology to stay ahead of the censors… We don’t want this technology to get rusty and obsolete. That is why we have decided to direct our anti-censorship resources into other places where Telegram is still banned by governments — places like Iran and China,” co-founder and chief executive Pavel Durov, who lived in Russia for years before going into self-imposed exile, posted on his personal Telegram channel on Monday.

The pledge noticeably came on the heels of the Russian government’s decision to lift its ban on Telegram last week. The app has generated impressive growth in Russia even after it was officially banned in the country in 2018 over its refusal to hand over encryption keys to the authorities who would then have access to users’ content. The restriction prompted the company to launch the “Digital Resistance” initiative that would provide anti-blocking tools to users.

As a result, Telegram resumed accessibility within weeks in most of Russia and the ban had since remained patchy. It doubled its monthly active users to 400 million in May since 2018, with 30 million coming from Russia.

Despite its popularity, the app is trapped in limbo as it copes with disgruntled investors who put up big bucks for the company’s ambitious blockchain platform, Telegram Open Network, which terminated abruptly in May.

It’s unclear why Russia suddenly decided to changed tack on Telegram. In a statement, Roskomnadzor, the telecommunications authority that initially ordered the ban, said the decision arrived after it had assessed the “readiness expressed by the founder of Telegram to counter terrorism and extremism.”

This inevitably raised questions of the kind of concession Telegram has made to the Russian state. Durov stressed that his company uses advanced mechanisms to detect and prevent terrorist acts without compromising user privacy, the very ethos of Telegram. Time will tell how the app can accommodate two challenging tasks that are widely seen as mutually exclusive.

The government may also have a motive to unblock Telegram, which is particularly popular among Russian youngsters, as a constitutional vote that could extend Putin’s rule is scheduled for next month.

In response to TechCrunch’s request for comment, Durov brought attention to the company’s counter-terrorism efforts and privacy policy. “There are no sudden changes / secret deals,” he said in a tweet.

Many users in countries where Telegram is inaccessible, like China, run the app with virtual private networks (VPN) or other forms of proxy. The app has turned into a refuge for Chinese users to share and discuss information censored by the authorities.

For instance, following Beijing’s crackdown on bitcoins in 2017, traders flocked to Telegram and other encrypted messengers that were out of reach by the Chinese government. Earlier this year, many Chinese citizens seeking clarity around the coronavirus situation got around the Great Firewall to join Telegram channels maintained by volunteers sharing hourly updates on the virus. One of the largest Chinese channels focused on COVID-19 has amassed more than 85,000 followers.

https://techcrunch.com/2020/06/22/telegram-anti-censorship-china-iran/

#HTE

Hello and welcome back to TechCrunch’s China Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. This week, we have several heavy-hitting rumors swirling around, from Huawei’s chips for cars to Tencent’s potential buyout of its video rival iQiyi.

China tech at home

Huawei’s foray into autos

Huawei might be bringing the technology behind its Kirin smartphone processor into cars. According to Chinese tech publication 36Kr, Huawei has signed a strategic deal with domestic electric car giant BYD, which would be using the Kirin chips to digitize the “cockpits” (generally refer to the drivers’ cabins) in its cars.

The Kirin chips are developed by Huawei’s semiconductor subsidiary HiSilicon to hedge against U.S. sanctions and become self-sufficient in core smartphone technologies. What’s noticeable is that BYD, backed by Warren Buffet, had previously announced to adopt Qualcomm’s Snapdragon automotive chips in its electric vehicles, a partnership that was set to begin in 2019. Could the potential collaboration with Huawei be part of BYD’s move to decrease reliance on imported technologies?

BYD said it “does not have information to disclose at the moment,” while Huawei declines to comment on the rumor.

The potential alliance would not be all that surprising given the duo has already been working together closely. In March 2019, the companies, both Shenzhen-based, unveiled a strategic partnership to apply Huawei’s AI and 5G technologies in BYD’s alternative energy vehicles and monorails.

Automotive independence

More big moves from BYD — the automaker is rushing to become self-sufficient in the production of electric vehicles. After raising a 1.9 billion yuan ($270 million) Series A in late May, its chipmaking subsidiary BYD Semiconductor completed another 800 million yuan ($113 million) Series A+ round this week, apparently due to investors’ immense interest in getting involved in the only Chinese company capable of making the core chip part of electric cars called insulated gate bipolar transistors, or IGBTs.

ByteDance encroaches on Tencent’s turf

ByteDance just paid 1.1 billion yuan ($160 million) for a big plot of land to build offices in the heart of Shenzhen’s Nanshan district, according to public information disclosed by the government. Shenzhen is home to multiple Chinese tech heavyweights, including Tencent, Huawei and DJI. It also houses the China offices of foreign retail giants such as Lazada and Shopify, given the city’s rich manufacturing and logistics resources.

That gives ByteDance, the parent of TikTok, a significant presence in Tencent’s backyard. ByteDance is known to have aggressively lured talents from the entrenched tech trio of Baidu, Alibaba and Baidu by offering lucrative packages. Being in Shenzhen will no doubt give the company more access to Tencent’s talent pool.

This may help it in its push into video gaming, an area that has long been dominated by Tencent, the world’s biggest games publisher. Meanwhile, the world’s second-largest games company — NetEase — is right next door in Guangzhou, an hour’s drive away from central Shenzhen.

Shakeup in video streaming

Reuters reported this week that Tencent has approached Baidu to become the biggest shareholder in iQiyi, the video streaming giant controlled by Baidu. Tencent’s video platform competes neck to neck with iQiyi to churn out variety shows and dramas that will convince Chinese audiences to pay for online content.

Both companies are bleeding money on video production. IQiyi, which shed from Baidu to list on Nasdaq, widened its net loss to 2.9 billion yuan ($406.0 million) in Q1 this year, up from 1.8 billion yuan the year before. Selling iQiyi to deep-pocketed Tencent may further ease the financial burden on Baidu, which is busy coping with ByteDance’s threat to its core advertising business. Both Tencent and iQiyi declined to comment on the report.

Robotics startup Geek+ raises $200 million

Geek+, a startup that specializes in making logistics robots that are analogous to those of Amazon’s Kiva machines, just closed a substantial Series C round. The company is one to watch as retail companies in China and North America are increasingly looking to automate their warehouses.

China tech abroad

China’s gay dating app Blued goes public on Nasdaq

Despite limited support for LGBTQ communities in China, Blued, a Chinese app used by millions of gay individuals, has been quietly blossoming over the past few years and is eyeing to raise $50 million from a U.S. initial public offering.

JD.com goes public in Hong Kong

JD’s long-awaited secondary listing is here. The online retailer’s shares rose 5.7% to HK$239 ($30.8) on its first day of trading on the Hong Kong Stock Exchange. Several U.S.-listed Chinese companies have filed to list in Hong Kong because of a new bill that will impose more scrutiny on Chinese firms trading on the U.S. stock markets.

https://techcrunch.com/2020/06/21/huawei-enters-cars-bytedance-new-headquarters/

#HTE

Over the past few months, COVID-19 has brought much of the fundraising community to a standstill. However, amidst it all India’s hyper0growth telco Reliance Jio Platforms has put its fundraising efforts into full gear.

Over the past three months, Jio has raised over $15.5 billion from a cohort of investors that include prominent financial institutions like KKR and Silver Lake Partners, massive sovereign wealth funds like Saudi Arabia’s Public Investment Fund, and some of the biggest names in tech including Facebook.

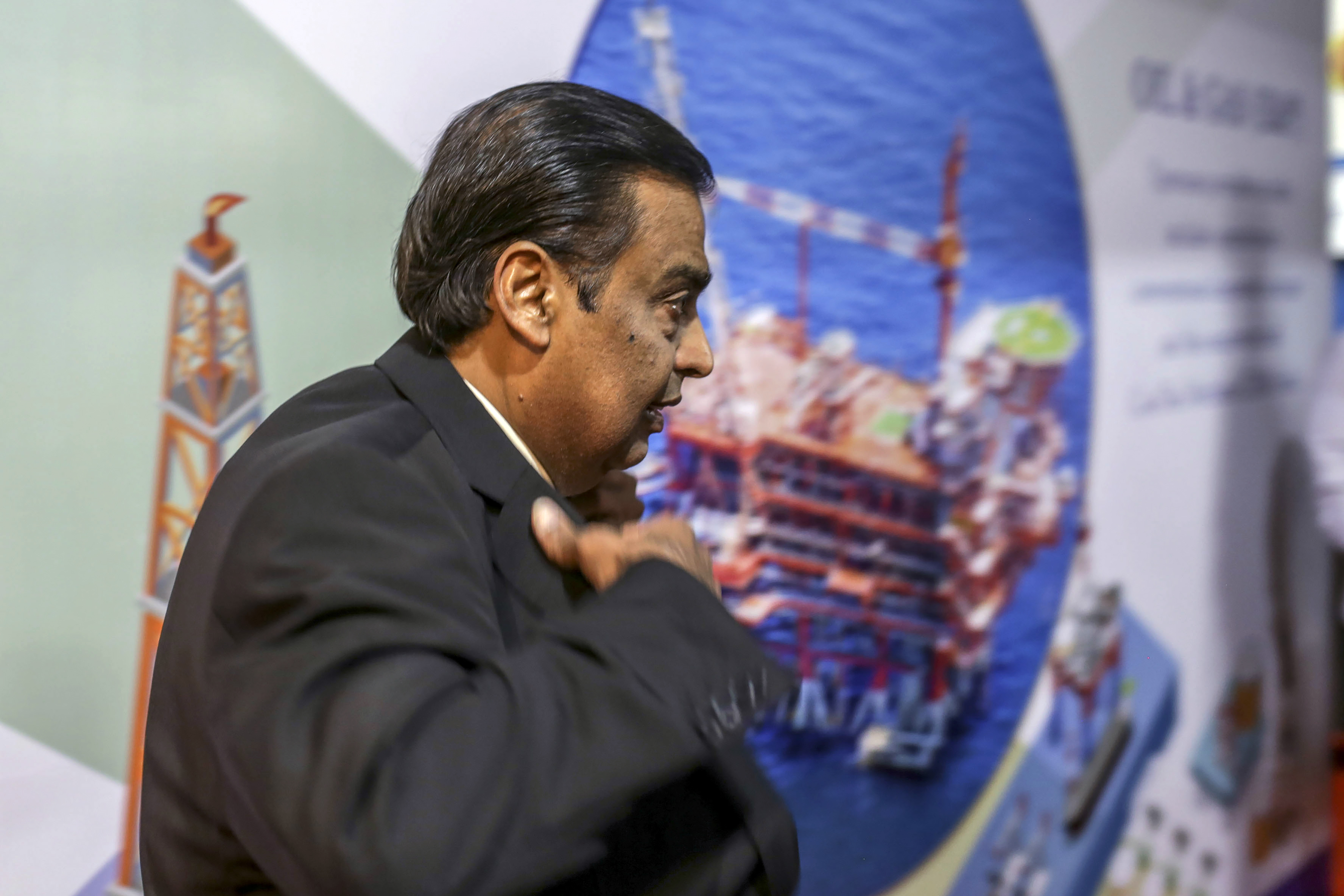

The recent deals have cemented Mukesh Ambani’s ambition to make his oil-to-retails giant Reliance Industries (India’s most valuable firm) a top homegrown internet giant.

On Friday, he said he plans to publicly list Reliance Jio Platforms and Reliance Retail, the largest retail chain in the country — also controlled by him — in the next five years.

As Reliance Jio Platforms, which has become the India’s top telecom operator with over 388 million subscribers in less than four years, continues its funding spree, at Extra Crunch we are doubling down on our focus on covering everything Jio from here and out.

As we’ve attempted to get up to speed on the company, we’ve compiled a supplemental list of resources and readings that we believe are particularly helpful for learning the story of Jio, which remains a mysterious firm to many.

https://techcrunch.com/2020/06/20/a-reading-guide-to-reliance-jio-the-most-important-tech-company-in-the-world/

#HTE

If your venture fund was not one of the ten investors that backed Reliance Jio Platforms in recent weeks, you won’t be able to plough cash into the fast-growing top Indian telecom network for at least a few quarters now as it is no longer scouting for fresh deals.

Reliance Jio Platforms, which has raised $15.2 billion in the past nine weeks, said today that Saudi Arabia’s PIF $1.5 billion investment on Thursday marked the “end of Jio Platforms’ current phase of induction of financial partners.”

Mukesh Ambani, who controls Reliance Industries (the parent firm of Jio Platforms and a range of other businesses), said that Jio Platforms and Reliance Retail, the largest retail chain in the country, “have received strong interest from strategic and financial investors,” but he will now “induct leading global partners in these businesses in the next few quarters.”

India’s richest man added that he plans to publicly list both Jio Platforms and Reliance Retail within the next five years. “With these initiatives, I have no doubt that your company will have one of the strongest balance sheets in the world.”

Mukesh Ambani, chairman and managing director of the Reliance Industries Ltd., arrives for the company’s annual general meeting in Mumbai, India, on Monday, Aug. 12, 2019. Photographer: Dhiraj Singh/Bloomberg via Getty Images

The announcement today caps perhaps the buzziest fundraising news cycle that lasted for nearly three months. Reliance Jio Platforms, which has amassed over 388 million subscribers in less than four years, announced in April that it had secured $5.7 billion from Facebook.

In the weeks since, the telecom operator has raised an additional $9.5 billion from a roster of nine high-profile investors including Silver Lake, KKR, and General Atlantic .

The huge capital infusion at the height of a global pandemic accounted for more than half of the investment into telecom companies globally this year, according to Bloomberg. By raising $15.2 billion, Jio Platforms, which Ambani describes as a “startup,” alone mopped up more capital than India’s entire tech startup ecosystem last year.

On Friday, Ambani also confirmed a market speculation about why Reliance Jio Platforms was raising money at all. Ambani said that the capital has helped him repay Reliance Industries’ net debt of $21 billion well ahead of schedule. The oil-to-retail giant, which was debt free in 2012, is now “net debt free,” he said.

Last August, Ambani promised shareholders that Reliance Industries, which is India’s most valued firm, would repay its debt by early 2021.

“Today I am both delighted and humbled to announce that we have fulfilled our promise to the shareholders by making Reliance net debt-free much before our original schedule of 31st March 2021,” he said.

https://techcrunch.com/2020/06/19/reliance-jio-platforms-says-15-2-billion-fundraise-is-good-for-now/

#HTE

It’s raised $5.7 billion from Facebook. It’s taken $1.5 billion from KKR, another $1.5 billion from Vista Equity Partners, $1.5 billion from Saudi Arabia’s Public Investment Fund, $1.35 billion from Silver Lake, $1.2 billion from Mubadala, $870 million from General Atlantic, $750 million from Abu Dhabi Investment Authority, $600 million from TPG, and $250 million from L Catterton.

And it’s done all that in just nine weeks.

India’s Reliance Jio Platforms is the world’s most ambitious tech company. Founder Mukesh Ambani has made it his dream to provide every Indian with access to affordable and comprehensive telecommunications services, and Jio has so far proven successful, attracting nearly 400 million subscribers in just a few years.

The unparalleled growth of Reliance Jio Platforms, a subsidiary of India’s most-valued firm (Reliance Industries), has shocked rivals and spooked foreign tech companies such as Google and Amazon, both of which are now reportedly eyeing a slice of one of the world’s largest telecom markets.

What can we learn from Reliance Jio Platforms’s growth? What does the future hold for Jio and for India’s tech startup ecosystem in general?

Through a series of reports, Extra Crunch is going to investigate those questions. We previously profiled Mukesh Ambani himself, and in today’s installment, we are going to look at how Reliance Jio went from a telco upstart to the dominant tech company in four years.

The birth of a new empire

Months after India’s richest man, Mukesh Ambani, launched his telecom network Reliance Jio, Sunil Mittal of Airtel — his chief rival — was struggling in public to contain his frustration.

That Ambani would try to win over subscribers by offering them free voice calling wasn’t a surprise, Mittal said at the World Economic Forum in January 2017. But making voice calls and the bulk of 4G mobile data completely free for seven months clearly “meant that they have not gotten the attention they wanted,” he said, hopeful the local regulator would soon intervene.

This wasn’t the first time Ambani and Mittal were competing directly against each other: in 2002, Ambani had launched a telecommunications company and sought to win the market by distributing free handsets.

In India, carrier lock-in is not popular as people prefer pay-as-you-go voice and data plans. But luckily for Mittal in their first go around, Ambani’s journey was cut short due to a family feud with his brother — read more about that here.

https://techcrunch.com/2020/06/19/how-reliance-jio-platforms-became-indias-biggest-telecom-network/

#HTE

Milk Mantra, a startup that procures, packages, sells and delivers milk and other dairy products, has raised $10 million in a new debt financing round as it looks to grow its business in India, where nearly a dozen startups have attempted and failed to serve this category in recent years.

U.S. International Development Finance Corporation (DFC) has committed a $10 million loan to Milk Mantra, said the Indian startup that has raised about $35 million by selling equity stake to date.

Headquartered in the state of Odisha, Milk Mantra has built the entire value chain for servicing dairy products, said Srikumar Misra, founder and chief executive of the startup, in an interview with TechCrunch.

Milk Mantra works directly with farmers, tests and processes the milk, and then sells it through more than 10,000 mom-and-pop stores in several cities in Odisha, said Misra. In the past one year, Milk Mantra has also launched a daily subscription service that delivers milk to customers’ homes.

The startup’s heavy reliance on these tiny store fronts is in contrast with how most other young firms operating in this space have attempted to cash in on India’s gigantic milk market that is the world’s largest in the dairy herd and where more than 170 million metric tons of milk is produced each year.

A wave of startups in recent years have tried to buy milk from informal collectors and then use an army of delivery people to distribute it. But because of the razor thin margin on milk, they have struggled to make economic sense that has resulted in a major consolidation and other exits in the market in recent years.

In the past two years, online grocery delivery firm BigBasket has acquired DailyNinja and RainCan, two startups that delivered milk, while a similar startup SuprDaily was snatched by food delivery startup Swiggy, and Doodhwala closed shop.

Milk Market’s founder and chief executive Srikumar Misra is also part of a task force setup by New Delhi-based think tank Niti Aayog to build an agri-stack for the country

Misra said having full-time delivery people is currently not sustainable for the milk business. Even for its to-door service, he said, Milk Mantra’s delivery force only parts three to four hours of their day to the startup. “As we scale our subscription service, it may account for 10 to 15% of our sales,” he said.

Relying on middlemen also means that the quality of milk gets deteriorated as they often add water, or powdered milk to artificially increase the volume. Misra, who started to explore this space after returning to India in 2009, said Milk Mantra has spent years to re-engineer how milk is sourced and sold in the country.

“In India, people still boil milk after getting it from their local parlour or delivery people because of trust deficit and other issues. So we re-engineered the packaging milk that prevents it from light exposure,” he said. The startup calls this milk product Milky Moo, the motto of which is “no need to boil.”

The startup works with more than 65,000 farmers today and has deployed IoT products and used data analytics to control quality and pricing. This has also helped farmers increase their income as the startup brings transparency on how much their milk is worth, said Misra.

Milk Mantra will deploy the fresh capital to build a digital financial services platform for its network of farmers. “This platform will drive financial inclusion for farmers, especially women farmers. It may be noted that there are nearly 100 million dairy farmers in India with a significant proportion being women,” the startup said.

It is also working to build a full-fledged chain in Kolkata, where it currently has limited presence.

https://techcrunch.com/2020/06/19/indias-milk-mantra-secures-10m-from-us-international-development-finance-corporation/

#HTE

Billionaire Mukesh Ambani has found yet another high-profile firm to write a massive check to his telecom venture Reliance Jio Platforms at the height of a global pandemic.

Saudi Arabia’s Public Investment Fund, one of the world’s largest sovereign wealth funds, said on Thursday it will invest $1.5 billion in Jio Platforms for a 2.32% stake in the top Indian telecom operator.

With this deal, Jio Platforms, which is India’s largest telecom operator with over 388 million subscribers, has secured $15.2 billion from ten investors including social giant Facebook in the past nine weeks by selling a 24.7% stake in its business.

For some comparison, India’s startup ecosystem raised $14.5 billion last year — in what was its best year.

Today’s announcement further illustrates the opportunities foreign investors see in Jio Platforms, a three-and-a-half-year-old subsidiary of Reliance Industries (India’s most valuable firm), that has upended the telecommunications market in India with cut-rate voice calls and mobile data tariffs.

Analysts at Bernstein said this week they expect Jio Platforms to reach 500 million customers by 2023, and control half of the market by 2025. Jio Platforms competes with Bharti Airtel and Vodafone Idea, a joint venture between British giant Vodafone and Indian tycoon Kumar Mangalam Birla’s Aditya Birla Group.

In a statement, Yasir Al-Rumayyan, Governor of PIF, said, “We are delighted to be investing in an innovative business which is at the forefront of the transformation of the technology sector in India. We believe that the potential of the Indian digital economy is very exciting and that Jio Platforms provides us with an excellent opportunity to gain access to that growth. This investment will also enable us to generate significant long-term commercial returns for the benefit of Saudi Arabia’s economy and our country’s citizens, in line with our mandate to safeguard and grow the national wealth of the Kingdom.”

Jio Platforms also owns a bevy of digital apps and services including music streaming service JioSaavn (which it says it will take public), on-demand live television service JioTV and payments app JioMoney, as well as smartphones, and broadband business. These services are available to Jio subscribers at no additional charge.

Pankaj Jain, a high-profile angel investor, told TechCrunch that Jio Platforms’ digital services suite appeared to have helped it attract foreign investors. “Foreign investors see that owning the pipes is a race to the bottom in terms of ARPU (average revenue per user) but having so many bundled services seems like it’s the future for telecommunications companies. By solidifying their content strategy, they have appealed to investors that are seeing this same strategy play out in other markets,” he said.

“Unfortunately, it’s still to be seen whether content can help increase margins significantly in India.”

Though Reliance Jio Platforms has not revealed why it is raising so much money, this capital could be deployed to cut oil-to-retails giant Reliance Industries’ net debt of about $21 billion, said Mahesh Uppal, director of communications consultancy firm Com First, in a conversation with TechCrunch.

Ambani pledged to clear Reliance’s due by early 2021. Reliance Industries had no debt in 2012, but that changed when the company decided to enter the telecommunications market.

“From Oil Economy, this relationship is now moving to strengthen India’s New Oil (Data-driven) Economy, as is evident from PIF’s investment into Jio Platforms. I have greatly admired the defining role PIF has played in driving the economic transformation of the Kingdom of Saudi Arabia,” said Ambani, India’s richest man, in a statement today.

https://techcrunch.com/2020/06/18/indias-reliance-jio-platforms-sells-1-5-billion-stake-to-the-public-investment-fund/

#HTE

Amazon said on Thursday it has expanded its Flex delivery program to more than 35 cities in India, one of its key overseas markets, as the e-commerce giant looks to scale its delivery capability to service the growing number of orders.

The e-commerce giant, which completed seven years in the country this month, launched the Amazon Flex delivery program in India last June. At the time, the program was available in three cities.

Amazon Flex allows individuals to help the company deliver packages to customers. The company said “tens of thousands” of students, homemakers and others have joined the program in India in the past one year and supplemented their income.

These individuals earn between Rs 120 ($1.58) to Rs 140 ($1.84) per hour. The company said the expansion of Amazon Flex to more cities will enable it to scale its delivery workforce and service customers more efficiently.

“Amazon Flex partners enjoy the part time opportunity to earn more, especially at this time when the country is economically recovering from the impact of the nationwide lockdown,” said Prakash Rochlani, Director of Last Mile Transportation at Amazon India, in a statement.

Amazon and its chief rival in India, Walmart’s Flipkart were severely hit when New Delhi announced a nationwide lockdown and prevented the e-commerce firms from servicing non-essential orders. India has since eased restrictions and both the firms have restored much of their services.

But in recent months, Amazon delivery people and warehouse workers have expressed severe safety concerns as Covid-19 spread more widely. In April, Reuters documented such fears shared by an Amazon Flex delivery driver.

The safety of these Amazon Flex partners “remains our top priority, and we are taking the right precautions, and have implemented a series of preventative health measures,” said Rochlani.

Amazon has been looking to aggressively expand its delivery workforce in India in recent weeks. The company said last month that it was looking to hire 50,000 seasonal workers. The company last year created 90,000 additional seasonal jobs, an Amazon spokesperson told TechCrunch, but it did so ahead of the festival Diwali, which sees Indians spend lavishly.

https://techcrunch.com/2020/06/18/amazon-expands-flex-delivery-program-to-more-than-35-cities-in-india/

#HTE

Geek+, a Beijing-based startup that makes warehouse fulfillment robots similar to those of Amazon’s Kiva, said Thursday that it has closed over $200 million in a Series C funding round.

That bumps total capital raised by the 5-year-old company to date to nearly $390 million. The new round, completed in two parts, was separately led by GGV Capital and D1 Capital Partners in the summer of 2019, and V Fund earlier this year. Other participants included Warburg Pincus, Redview Capital and Vertex Ventures.

The company said it will continue to develop robotics solutions tailored to logistics, ramp up its robot-as-a-service monetization model, and expand partnerships.

Geek+ represents a rank of Chinese robotics solution providers that are increasingly appealing to clients around the world. The startup itself boasts over 10,000 robots deployed worldwide, serving 300 customers and projects in over 20 countries.

Just last month, Geek+ announced a partnership with Conveyco, an order fulfillment and distribution center system integrator operating in North America, to distribute its autonomous mobile robots (ARMs) across the continent. Leading this part of its business is Mark Messina, the startup’s chief operating officer for the Americas who previously worked at Amazon, where he oversaw mechanical engineering for the Kiva robotics system.

Geek+’s ambitious move overseas came amid continuous pressure from the Trump administration to boycott Chinese tech players. Back home, Geek+ has worked closely with retail giants such as Alibaba and Suning to replace human pickers in warehouses.

https://techcrunch.com/2020/06/17/geek-plus-200-million-series-c/