asia

#HTE

It used to be “easy” to tell the American and Chinese economies apart. One was innovative, one made clones. One was a free market while the other demanded payments to a political party and its leadership, a corrupt wealth generating scam that by some estimates has netted top leaders billions of dollars. One kept the talent borders porous acting as a magnet for the world’s top brains while the other interviewed you in a backroom at the airport before imprisoning you on sedition charges (okay, that might have been both).

The comparison was always facile yes, but it was easy and at least directionally accurate if failing on the specifics.

Now though, the country that exported exploding batteries is pioneering quantum computing, while the country that pioneered the internet now builds planes that fall out of the sky (and good news, we’ve identified even more planes that might fall out of the sky at an airport near you!)

TikTok’s success is many things, but it is quite frankly just an embarrassment for the United States. There are thousands of entrepreneurs and hundreds of venture capitalists swarming Silicon Valley and the other American innovation hubs looking for the next great social app or building it themselves. But the power law of user growth and investor returns happens to reside in Haidian, Beijing. ByteDance through its local apps in China and overseas apps like TikTok is the consumer investor return of the past decade (there’s a reason why all the IPOs this seasons are enterprise SaaS).

It’s a win that you can’t chalk up just to industrial policy. Unlike in semiconductors or other capital-intensive industries where Beijing can offer billions in incentives to spur development, ByteDance builds apps. It distributes them on app stores across the world. It has exactly the same tools available to it that every entrepreneur with an Apple Developer account has access to. There is no Made in China 2025 plan to build and popularize a consumer app like TikTok (you literally can’t plan for consumer success like that). Instead, it’s a well-executed product that’s addictive to hundreds of millions of people.

So much as China protected its industry from overseas competitors like Google and Amazon through market-entry barriers, America is now protecting its entrenched incumbents from overseas competitors like TikTok. We’re demanding joint ventures and local cloud data sovereignty just as the Communist Party has demanded for years.

Hell, we’re apparently demanding a $5 billion tax payment from ByteDance, which the president says will fund patriotic education for youth. The president says a lot of things of course, but at least the $5 billion price point has been confirmed by Oracle in its press release over night (what the tax revenue will actually be used for is anyone’s guess). If you followed the recent Hong Kong protests for a long time, you will remember that patriotic youth education was some of the original tinder for those demonstrations back in 2012. What comes around, goes around, I guess.

Development economists like to talk about “catch-up” strategies, tactics that countries can take to avoid the middle income trap and cut the gap between the West and the rest. But what we need now are developed economists to explain America’s “fall behind” strategy. Because we are falling behind, in pretty much everything.

As the TikTok process and the earlier Huawei imbroglio show, America is no longer on the leading edge of technology in many key strategic markets. Mainland Chinese companies are globally winning in areas as diverse as 5G and social networks, and without direct government intervention to kill that innovation, American and European tech purveyors would have lost those markets entirely (and even with those interventions, they may still lose them). In Taiwan, TSMC has come from behind Intel to take a year or two lead in the fabrication of the most advanced semiconductors.

I mean, we can’t even pilfer Chinese history and mythology and turn it into a decent god damn film these days.

And the fall-behind strategy continues. Immigration restrictions from an administration hell-bent on destroying the single greatest source of American innovation, coupled with the COVID-19 pandemic, have fused into the largest single drop in international student migration in American history.

Why does that matter? In the U.S. according to relatively recent data, 81% of electrical engineering grad students are international, 79% in computer science are, and in most engineering and technical fields, the number hovers above a majority.

It’s great to believe the fantasy that if only these international grad students would stay home, then “real” Americans would somehow take these slots. But what’s true of the strawberry pickers and food service workers is also true for EE grad students: proverbial “Americans” don’t want these jobs. They are hard jobs, thankless jobs, and require a ridiculous tenacity that American workers and students by and large don’t have. These industries have huge contingents of foreign workers precisely because no one domestic wants to take these roles.

So goes the talent, so goes the innovation. Without this wellspring of brainpower lodging itself in America’s top innovation hubs, where exactly do we think it will go? That former aspiring Stanford or MIT computer scientist with ideas in his or her brain isn’t just going to sit by the window gazing at the horizon waiting for the moment when they can enter the gilded halls of the U.S. of A. It’s the internet era, and they are just going to get started on their dreams wherever they are, using whatever tools and resources they have available to them.

All you have to do is look at the recent YC batches and realize that the future cohorts of great startups are going to increasingly come from outside the continental 48. Dozens of smart, brilliant entrepreneurs aren’t even trying to migrate, instead rightfully seeing their home markets as more open to innovation and technological progress than the vaunted superpower. The frontier is closed here, and it has moved elsewhere.

So what are we left with here in the U.S. and increasingly Europe? A narrow-minded policy of blocking external tech innovation to ensure that our sclerotic and entrenched incumbents don’t have to compete with the best in the world. If that isn’t a recipe for economic disaster, I don’t know what is.

But hey: at least the youth will be patriotic.

https://techcrunch.com/2020/09/20/gangster-capitalism-and-the-american-theft-of-chinese-innovation/

#HTE

Well… that was pointless.

After debasing the idea of free commerce in the U.S in the name of a misplaced security concern, stringing along several multi-billion dollar companies that embarrassed themselves in the interest of naked greed, and demanding that the U.S. government get a cut of the profits, the TikTok saga we’ve been watching the past few weeks finally appears to be over.

A flurry of announcement late Saturday night indicate that the TikTok deal was actually a politically-oriented shakedown to boost the cloud infrastructure business of key supporters of the President of the United States.

Oracle, whose cloud infrastructure services run a laughable fourth to AWS, Alphabet*, and Microsoft, will be taking a 20 percent stake in TikTok alongside partner Walmart in what will be an investment round before TikTok Global (as the new entity will be called) goes public on an American stock exchange.

According to a statement from TikTok, Oracle will become TikTok’s “trusted technology partner” and will be responsible for hosting all U.S. user data and securing associated computer systems to ensure U.S. national security requirements are fully satisfied. “We are currently working with Walmart on a commercial partnership as well,” according to the statement from TikTok.

Meanwhile, Oracle indicated that all the concerns from the White House, U.S. Treasury, and Congress over TikTok had nothing to do with the service’s selection of Oracle as its cloud provider. In its statement, Oracle said that “This technical decision by TikTok was heavily influenced by Zoom’s recent success in moving a large portion of its video conferencing capacity to the Oracle Public Cloud.”

The deal benefits everyone except U.S. consumers and people who have actual security concerns about TikTok’s algorithms and the ways they can be used to influence opinion in the U.S.

TikTok’s parent company ByteDance gets to maintain ownership of the U.S. entity, Oracle gets a huge new cloud customer to boost its ailing business, Walmart gets access to teens to sell stuff, and U.S. customer data is no safer (it’s just now in the hands of U.S. predators instead of foreign ones).

To be clear, data privacy and security is a major concern, but it’s not one that’s a concern when it comes to TikTok necessarily (and besides, the Chinese government has likely already acquired whatever data they want to on U.S. customers).

For many observers, the real concern with TikTok was that the company’s Chinese owners may be pressured by Beijing to manipulate its algorithm to promote or suppress content. Companies in China — including its internet giants — are required to follow the country’s intelligence and cloud security law mandating complete adherence with all government orders for data.

The Commerce Department in its statement said that “In light of recent positive developments, Secretary of Commerce Wilbur Ross, at the direction of President Trump, will delay the prohibition of identified transactions pursuant to Executive Order 13942, related to the TikTok mobile application that would have been effective on Sunday, September 20, 2020, until September 27, 2020 at 11:59 p.m.” So that’s a week reprieve.

So all this sound and fury … for what? The best investment return in all of these shenanigans is almost certainly Oracle co-CEO Safra Catz’ investment into Trump, who in addition to being a heavy donor to the Trump administration, also joined the presidential transition committee back in 2016. Thank god the U.S. saved TikTok from the crony capitalism of China. Let’s just hope they enjoy the crony capitalism of Washington DC.

*An earlier version of this article referred to AWS, Amazon and Microsoft. AWS and Amazon are the same company. I was typing fast. I’ve corrected the error.

https://techcrunch.com/2020/09/19/tiktok-deal-terms/

#HTE

The backlash against vaping in the United States has not deterred a Chinese challenger from entering the world’s largest vaping market.

Relx, one of China’s largest e-cigarette companies, is seeking to submit its Premarket Tobacco Product Application to the U.S. Food and Drug Administration by the end of 2021. Upon completion of a review process that will take no longer than 180 days, the FDA will take “action”, which could be marketing authorization, a request for more information, or denial.

The vaping startup has requested a pre-submission meeting with the FDA and is expected to meet with the regulator in October, said Donald Graff, the two-year-old startup’s head of scientific affairs for North America, appearing in a video during a press event this week in Shenzhen.

Graff had a brief stint at Juuls Labs as its principal scientist after a 13-year streak at clinical research company Celerion where he oversaw tobacco studies. He’s now spearheading PMTA for Relx. Another scientist from Juuls, Xing Chengyue, who helped invent the nicotine salts critical to e-cigarettes, also joined in China’s vaping industry and founded her own startup Myst.

PMTA is an extensive, meticulous, costly bureaucratic process for vaping products to establish that they are “appropriate for the protection of public health” before being marketed in the U.S. Relx, headquartered in the world’s e-cigarette manufacturing hub Shenzhen, has set up a team to work on the application process, including hiring third-party consulting services and clinical partners to generate data from tests that are necessary for the submission.

All e-cigarette companies currently on the U.S. market needed to submit their PMTA by September 10 this year. To date, no products have received marketing authorization by the FDA.

The high costs of PMTA keep many small players from entering the U.S., but Relx has the financial prowess to bear the expense — it estimates the entire process will cost it more than $20 million. A Nielson survey Relx commissioned showed that the company had a nearly 70% share of China’s pod vape market as of April.

As the risks associated with e-cigarettes continue to draw attention from regulators around the world, Relx has ramped up its research investments to examine vaping’s impact on public health. At this week’s event, its chief executive Kate Wang, a rare female founder of a major tech company in China, and previously the general manager of Uber China, repeatedly highlighted “science” as a key focus at her startup.

Recently unveiled is the company’s Shenzhen-based bioscience lab, which is measuring the effects of Relx vapors through in vivo and in vitro tests, as well as conducting pre-clinical safety assessments.

Despite its ongoing efforts to prove the benefit of switching from smoking to vaping, Relx alongside its rivals faces regulatory uncertainties across various markets. The Trump administration banned flavored vape products last year (Relx plans to submit unflavored products for FDA review) and India banned e-cigarettes citing adverse health impacts on youth.

When asked how the startup plans to cope with changing policies, a Relx executive said at the event that “the company keeps a good relationship with regulators from various countries.”

“You can’t make conclusions on something that is still in the process,” said the executive, referring to the early stage of the vaping industry.

https://techcrunch.com/2020/09/18/china-relx-gears-up-for-us-entry/

#HTE

Google has pulled Indian financial services app Paytm from the Play Store for violating its gambling policies. Paytm is India’s most valued startup and claims over 50 million monthly active users. Its marquee app, which allows users to exchange money with one another, disappeared from the Play Store in India earlier Friday.

On Friday, Google said that Play Store prohibits online casinos and other unregulated gambling apps that facilitate sports betting in India, a day before the popular cricket tournament Indian Premier League is scheduled to kick off. Paytm app repeatedly violated company’s policies, two people familiar with the matter told TechCrunch.

The Android-maker, which maintains similar guidelines in most other markets, additionally noted that if an app leads consumers to an external website that allows them to participate in paid tournaments to win real money or cash prizes is also in violation of its Play Store policies.

TechCrunch has reached out to Paytm but has yet to hear back.

Previous seasons of IPL, which last for nearly two months and attract the attention of hundreds of millions of Indians, have seen a surge in apps that look to promote or participate in sports betting.

Sports betting is banned in India, but fantasy sports where users select their favorite players and win if their preferred team or players play well is not illegal in most Indian states.

A person familiar with the matter told TechCrunch that Google has also asked Disney+ Hotstar, one of the most popular on-demand video streaming services in India, to display a warning before running ads for fantasy sports apps.

“We have these policies to protect users from potential harm. When an app violates these policies, we notify the developer of the violation and remove the app from Google Play until the developer brings the app into compliance,” wrote Suzanne Frey, Vice President, Product, Android Security and Privacy, in a blog post.

“And in the case where there are repeated policy violations, we may take more serious action which may include terminating Google Play Developer accounts. Our policies are applied and enforced on all developers consistently,” she added.

More to follow…

https://techcrunch.com/2020/09/18/google-pulls-indias-paytm-app-from-play-store-for-repeat-policy-violations/

#HTE

Apple will launch its online store in India on September 23, bringing a range of services directly to customers in the world’s second largest smartphone market for the first time in over 20 years since it began operations in the country.

The company, which currently relies on third-party online and offline retailers to sell its products in India, said its online store will offer AppleCare+, which extends the warranty on its hardware products by up to two years, as well as a trade-in program to let customers access discounts on purchase of new iPhones by returning previous models. These programs were previously not available in India.

“We know our users are relying on technology to stay connected, engage in learning, and tap into their creativity, and by bringing the Apple Store online to India, we are offering our customers the very best of Apple at this important time,” said Deirdre O’Brien, Apple’s senior vice president of Retail + People, in a statement.

TechCrunch reported in January that the iPhone-maker was planning to launch its online store in India in Q3 this year. A month later, Apple CEO Tim Cook confirmed the development, adding that Apple will also launch its first physical store in the country next year.

On its website, Apple says it also plans to offer financing options to customers in India, and students will receive additional discounts on Apple products and accessories. Starting next month, it will also let customers check out free online sessions on music and photography from professional creatives. And if they wish, they can engrave emoji or text on their AirPods in several Indian languages.

The launch of the online store will mark a new chapter in Apple’s business in India, where about 99% of the market is commanded by Android smartphones. The iPhone-maker has become visibly more aggressive in India in recent years. In July, the company’s contract manufacturing partner (Foxconn) began assembling the iPhone 11 in India. This was the first time the company was locally assembling a current-generation iPhone model in the country.

Assembling handsets in India enables smartphone vendors — including Apple — to avoid roughly 20% import duty that the Indian government levies on imported electronics products.

https://techcrunch.com/2020/09/17/apple-will-launch-its-online-store-in-india-on-september-23/

#HTE

In China, short video apps aren’t just for mindless time killing. These services are becoming online bazaars where users can examine products, see how they are grown and made, and ask sellers questions during live sessions.

Kuaishou, the main rival of TikTok’s Chinese version (Douyin), announced that it accumulated 500 million e-commerce orders in August, a strong sign for the app’s monetization effort — and probably a conducive condition for its upcoming public listing.

On the heels of the announcement, Reuters reported that Kuaishou, a Tencent-backed company behind TikTok clone Zynn, is looking to raise up to $5 billion from an initial public offering in Hong Kong as early as January. The company declined to comment, but a source with knowledge of the matter confirmed the details with TechCrunch.

There are intricacies in the claim of “500 million orders.” It doesn’t exclude canceled orders or refunds, and Kuaishou won’t reveal what its actual sales were. The company also said the number made it China’s fourth-largest e-commerce player following Alibaba, JD.com and Pinduoduo.

It’s hard to verify the claim as there are no comparable figures from these firms during the period, but let’s work with what’s available. Pinduoduo previously said it logged over 7 billion orders in the first six months of 2019. That means it averaged 1.16 billion orders per month, more than doubling Kuaishou’s volume.

Kuaishou’s figure, however, does indicate that many users have bought or at least considered buying through its video platform.

The app, known for its celebration of vernacular and even mundane user content, boasts 300 million daily active users at the latest, which suggests on average its users made at least one order during the month. Many of the products sold were produce grown by its large base of rural users. The app gained ground in small towns and far-flung regions early on exactly because its content algorithms didn’t intend to favor the “glamorous”.

Over time, it gathered pace among Chinese urbanites who found themselves enjoying others’ candid filming of country life and happily ordering their farm products. The focus on bringing rural produce to urban areas also squares nicely with China’s push to invigorate its rural economy, and it’s not rare to see Kuaishou using terms like “poverty-alleviation” in its social media campaign.

Douyin, which leans towards polished videos from “influencers”, also enables its content creators to monetize — through both sharing ad revenue and hawking products. With a DAU twice as big as Kuaishou’s at 600 million, the app vows to bring 80 billion yuan ($11.8 billion) of income to creators in the coming year, the chief executive of ByteDance China, Kelly Zhang, said recently at Douyin’s creator conference.

https://techcrunch.com/2020/09/17/tiktoks-chinese-rival-kuaishou-becomes-a-popular-online-bazaar/

#HTE

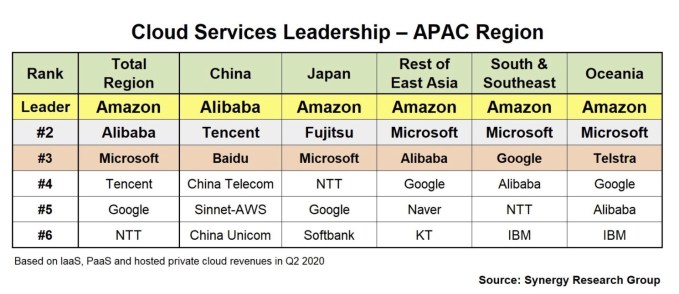

When you look at the Asia-Pacific (APAC) regional cloud infrastructure numbers, it would be easy to think that one of the Chinese cloud giants, particularly Alibaba, would be the leader in that geography, but new numbers from Synergy Research show Amazon leading across the region overall, which generated $9 billion in revenue in Q2.

The only exception to Amazon’s dominance was in China, where Alibaba leads the way with Tencent and Baidu coming in second and third, respectively. As Synergy’s John Dinsdale points out, China has its own unique market dynamics, and while Amazon leads in other APAC sub-regions, it remains competitive.

“China is a unique market and remains dominated by local companies, but beyond China there is strong competition between a range of global and local companies. Amazon is the leader in four of the five sub-regions, but it is not the market leader in every country,” he explained in a statement.

Image Credits: Synergy Research

The $9 billion in revenue across the region in Q2 represents less than a third of the more than $30 billion generated in the worldwide market in the quarter, but the APAC cloud market is still growing at more than 40% per year. It’s also worth pointing out as a means of comparison that Amazon alone generated more than the entire APAC region, with $10.81 billion in cloud infrastructure revenue in Q2.

While Dinsdale sees room for local vendors to grow, he says that the global nature of the cloud market in general makes it difficult for these players to compete with the largest companies, especially as they try to expand outside their markets.

“The challenge for local players is that in most ways cloud is a truly global market, requiring global presence, leading edge technology, strong brand name and credibility, extremely deep pockets and a long-term focus. For any local cloud companies looking to expand significantly beyond their home market, that is an extremely challenging proposition,” Dinsdale said in a statement.

https://techcrunch.com/2020/09/17/apac-cloud-infrastructure-revenue-reaches-9b-in-q2-with-amazon-leading-the-way/

#HTE

Severe droughts have drained rivers and reservoirs across parts of India, and more than half a billion people in the world’s second-most populous nation are estimated to run out of drinking water by 2030.

Signs of this are apparent in farms, which consume the vast majority of total water supplies. Farmers have been struggling in India to grow crops, as they are still heavily reliant on rainwater. Those with means have shifted to grow crops such as pearl millet, cow peas, bottle gourd and corn — essentially anything but rice — that use a fraction of the water. But most don’t have this luxury.

If that wasn’t enough, Indian cities are facing another challenge: The level of harmful chemicals used in vegetables has gone up significantly over the years.

A Hyderabad-headquartered startup, which is competing in the TechCrunch Disrupt Startup Battlefield this week, thinks it has found a way to address both of these challenges.

Across many of its centres in Hyderabad and Bangalore that look like spaceships from the inside, UrbanKisaan is growing crops, stacked one on top of another.

Vertical farming, a concept that has gained momentum in some Western markets, is still very new in India.

The model brings with it a range of benefits. Vihari Kanukollu, the co-founder and chief executive of UrbanKisaan, told TechCrunch in an interview that the startup does not use any soil or harmful chemicals to grow crops and uses 95% less water compared to traditional farms.

“We have built a hydroponic system that allows water to keep flowing and get recycled again and again,” he said. Despite using less water, UrbanKisaan says it produces 30% more crops. “We grow to at least 30-40 feet of height. And it has an infinite loop there,” he said.

Kanukollu, 26, said that unlike other vertical farming models, which only grow lettuce and basil, UrbanKisaan has devised technology to grow over 50 varieties of vegetables.

The bigger challenge for UrbanKisaan was just convincing businesses like restaurant chains to buy from it. “Despite us offering much healthier vegetables, businesses still prefer to go with traditionally grown crops and save a few bucks,” he said.

So to counter it, UrbanKisaan sells directly to consumers. Visitors can check in to centres of UrbanKisaan in Hyderabad and Bangalore and buy a range of vegetables.

The startup, backed by Y Combinator and recently by popular South Indian actress Samantha Akkineni, also sells kits for about $200 that anyone can buy and grow vegetables in their own home.

Kanukollu, who has a background in commerce, started to explore the idea about UrbanKisaan in 2018 after being frustrated with not being able to buy fresh, pesticide-free vegetables for his mother, he said.

Luckily for him, he found Sairam Palicherla, a scientist who has spent more than two decades studying farming. The duo spent the first year in research and engaging with farmers.

Today, UrbanKisaan has more than 30 farms. All of these farms turned profitable in their first month, said Kanukollu.

“We are currently growing at 110% average month on month in sales and our average bill value has gone up by 10 times in the last 6 months,” he said.

The startup is also working on reaching a point within the next three months to achieve $150,000 in monthly recurring revenue.

The startup has spent the last few quarters further improving its technology stack. Kanukollu said they have cut down on power consumption from the LED lights by 50% and reduced the cost of manufacturing by 60% per tube.

Kanukollu said the startup works with five farmers currently and is working out ways to find a viable model to bring it to every farmer.

It is also developing a centralized intelligence atop convolutional neural networks to achieve real-time detection to find more harvestable produce, and detect deficiencies in the farm.

UrbanKisaan, which has raised about $1.5 million to date, plans to expand to more metro cities in the country in the coming quarters.

https://techcrunch.com/2020/09/17/urbankisaan-is-betting-on-vertical-farming-to-bring-pesticide-free-vegetables-to-consumers-and-fight-indias-water-crisis/

#HTE

Despite the coronavirus outbreak, which has slowed down deal-making across the world, dozens of startups in India have raised considerable amounts in recent months. Unacademy, which raised $110 million in February, closed a new round of $150 million this month.

These large check sizes, and the frequency at which they are being bandied out, were almost unheard of in India just 10 years ago. The list of problems these local startups were solving then was also quite smaller back in the day.

Karthik Reddy has seen this change very closely.

He co-founded venture capital firm Blume Ventures, where he also serves as a partner, 10 years ago. Blume Ventures is the largest Indian venture capital firm. In a wide-ranging interview at Disrupt 2020, Reddy talked about the state of the startup ecosystem in India, some of the challenges it is confronting today and what lies ahead for the market.

“Fifteen years is what you should consider the active VC build-out in India. For the first five to seven years, we were kind of faking it till we make it. We sold the idea that we can replicate what the U.S. and China have done,” he said.

The breakout moment in India happened when low-cost Android smartphones flooded the market. A handful of startups with consumer-facing services such as Flipkart, Paytm and Zomato emerged to serve the first tens of millions of smartphone users in the country.

“The Hail Mary moment there was Reliance Jio’s arrival in the market,” he said. India’s richest man, Mukesh Ambani, entered the telecommunications market in the second half of 2016 with the world’s cheapest mobile tariff.

Moreover, for several months, Ambani simply did not charge Jio subscribers anything for access to 4G data. So India at large, once conscious about each megabyte it spent on the internet, suddenly started consuming gigabytes of content everyday. “It democratized data and smartphones at a scale that we have not seen in countries other than China,” said Reddy.

Karthik Reddy is the co-founder of Blume Ventures, the largest Indian venture capital firm

As hundreds of millions of users in India arrived on the internet, scores of startups in the country started to solve more complex problems: Bangalore-based startup Meesho today is helping millions of women sell products digitally; Classplus, a Blume Ventures-backed startup, has built a Shopify-like platform for teachers and coaching centres to serve students directly.

As India grew into the world’s second largest internet consumer, it has also attracted American and Chinese technology groups, all of which are looking for their next billion users. Several major investment firms, including Silver Lake, Alibaba Group, Tencent, GGV Capital, Tiger Global, General Atlantic, KKR, Vista, and Owl Ventures have also arrived and become aggressive in their investments in recent years.

But the geo-political tension between India and China have slightly complicated matters. In April this year, India amended its foreign direct investment policy to China to seek approval from New Delhi for their future deals in the country. Chinese investors have ploughed billions of dollars into the Indian startup ecosystem in recent years.

It’s a sensitive topic, given the involvement of the government, that most VCs in India are not comfortable addressing it even off the record. But Reddy weighed in.

“If not an arm or limb, it cuts off a finger or two for your choices. You are a little handicapped,” he said. “But there’s a caveat to that. It’s limited to certain segments of the market. I don’t think China and Hong Kong investors, even though they were very familiar with Chinese VC success story, were really interested in India’s deep tech and cross-border tech,” he said.

Today those areas account for more than a third of the robust ecosystem in India, Reddy argued. “If you look at the entire ecosystem collectively, there’s a single-digit influence of Chinese capital. […] If you ask me personally, 40% of my portfolio is not even remotely affected by it,” he said.

But several large consumer-facing Indian startups, such as Paytm, Zomato and Udaan, do have Chinese investors on their cap tables. Reddy said they would be impacted as uncertainty looms over when — and if — India would offer any relaxation to its current stand.

He said he is hopeful that the government would provide some distinction to VC-managed fund money that is not necessarily Chinese just because it’s run by someone who originated there.

Reddy also spoke about why he thinks early-stage startups, despite the proliferation of VC firms in India focusing on young firms, continue to receive less attention. We also spoke about how the coronavirus is impacting his portfolio startups and the industry at large and what advice he has for startup founders to navigate the turbulence times. You can watch this and much more in the interview below.

https://techcrunch.com/2020/09/17/blume-ventures-karthik-reddy-on-indian-startup-ecosystem-geo-political-tension-with-china-and-coronavirus/

#HTE

Melisa Irene‘s path to becoming a partner at one of Southeast Asia’s most esteemed venture capital firms is an unconventional one.

“I always consider myself to be quite lucky,” said Irene, who was promoted to be a partner at East Ventures in January 2019. At 25 years old, she was the Jakarta-based investment firm’s first female partner.

During TechCrunch Disrupt’s first online conference, I spoke to Irene about what she humbly described as a “lucky” career, her experience as a young, female investor, the rush of American and Chinese VC money into Southeast Asia, and what the COVID-19 pandemic means to East Ventures . A video recording of the conversation is at the bottom of the article.

Partner at 25

Irene admitted that timing played a big part in her ascension in the VC world. The development of Indonesia’s internet infrastructure came around relatively late — around 2010 — compared to more developed markets, but growth happened rapidly. In 2015, five years after East Ventures backed the Series A of Tokopedia, now an e-commerce leader in Southeast Asia, Irene joined the firm.

In those days, “I didn’t compete with a lot of investment bankers,” said Irene, who majored in accounting in university and began as an intern at East Ventures. “The capability that they looked for was how fast you can immerse in the ecosystem.”

Contrary to popular belief, the Southeast Asian investment ecosystem is “quite friendly” towards women. “People rejoice the promotion of female professionals in this industry. It’s not a rare circumstance to see females becoming a vice principal or principle in Southeast Asia,” the investor said.

The support goes beyond simply checking the gender-diversity box and reflects a real demand for more empathetic investors in the tech industry.

“Sometimes people like to talk as a business partner and sometimes as a friend. [Empathy] is something that can be seen as natural coming from females,” she added.

However, the investor cautioned that “the number of [female] decision-makers definitely needs to improve,” though she foresees the local ecosystem “is supportive of that.”

SEA gold rush

In recent years tech giants from both the U.S. and China have been clamoring to get into Southeast Asia, a region home to about 670 million people and a fledgling internet market. They often begin by financing local upstarts, which, beholden to the investment, will provide directional advice to their foreign corporate investors.

Indeed, the familiar names have all bet on the region’s rising stars. Alibaba invested in Tokopedia and its rival JD.com backed travel portal Traveloka, which is also in the East Ventures portfolio. Tencent, Google, Facebook and Paypal are all investors of Gojek, the Indonesian ride-hailing titan going neck and neck with SoftBank-funded Grab.

When offered big checks, startups must stay level-headed and think what’s best for them, Irene advised. “The thing is everyone has money. Companies need to decide which side to be on, what companies they want on board, and what companies are able to give them strategic advice.”

It’s not uncommon to see investors and founders clash over priorities. Some investors want a quick exit, while the entrepreneurial mentality is to build a business in the long run. “That’s why alignment is important,” asserted the investor.

The future of tech in SEA

As unicorns and “super apps” like Grab and Gojek emerge in Southeast Asia, concerns that incumbents can kill off competition grow. East Ventures has a unique insight into the region’s competitive dynamics as an early-stage investor that has seen some of its startups like Tokopedia and Traveloa grow into behemoths.

Irene believed as Southeast Asia’s internet ecosystem matures, there are actually a lot of opportunities for startups in “upcoming sectors.”

“If you look at the unicorns, you see a lot of younger and smaller companies supporting them,” she said. The point is that giants can’t accomplish everything by themselves, and some of the more niche functions can best be tackled by smaller players with specialized focuses.

On the other hand, the investor believed consolidation is possible — and should happen — in areas that can benefit from scale and network effects.

“People think of Indonesia as one country. We are not. We are the largest archipelago, which means there are very different infrastructures within different provinces. For example, it’s expensive to set up a bank branch in a small island… That means a lot of things need to come into a collective effort and one big ecosystem to offer the consumers with different kinds of offerings.”

Lastly, there’s the inevitable question of COVID-19. Like many investors, Irene saw a silver lining during the dark times.

“Before COVID, it was very difficult to assess the quality of companies. They all had a lot of money and the infrastructure was actually good… Now we suddenly can tell who makes good decisions, who makes it at what speed, and what is the outcome of those decisions. The way entrepreneurs respond to COVID can tell us a lot about their enterprises.”

https://techcrunch.com/2020/09/16/east-ventures-melisa-irene-on-southeast-asia/